Bitcoin Needs Over $9,100 Rally to Reach Inflation-Adjusted All-Time High

This is a segment from the Empire newsletter.

Gary Gensler, the IMF, and the World Economic Forum are significant influences on the crypto landscape, especially regarding inflation.

Bitcoin has not returned to its all-time high of $68,998 from November 2021 due to inflation. Adjusted for inflation, that figure would be approximately $77,975 today, reflecting a cumulative inflation rate of 13% based on US consumer price index data.

To exceed this adjusted all-time high, bitcoin must increase by over $9,100, equating to a 14% rise. Without inflation adjustments, bitcoin is only $4,900 away from its previous peak, or a 6.7% increase.

As inflation persists, bitcoin’s inflation-adjusted all-time high continues to rise. In March, bitcoin reached a local top of $76,744 but peaked at $73,738, falling short by about 4%.

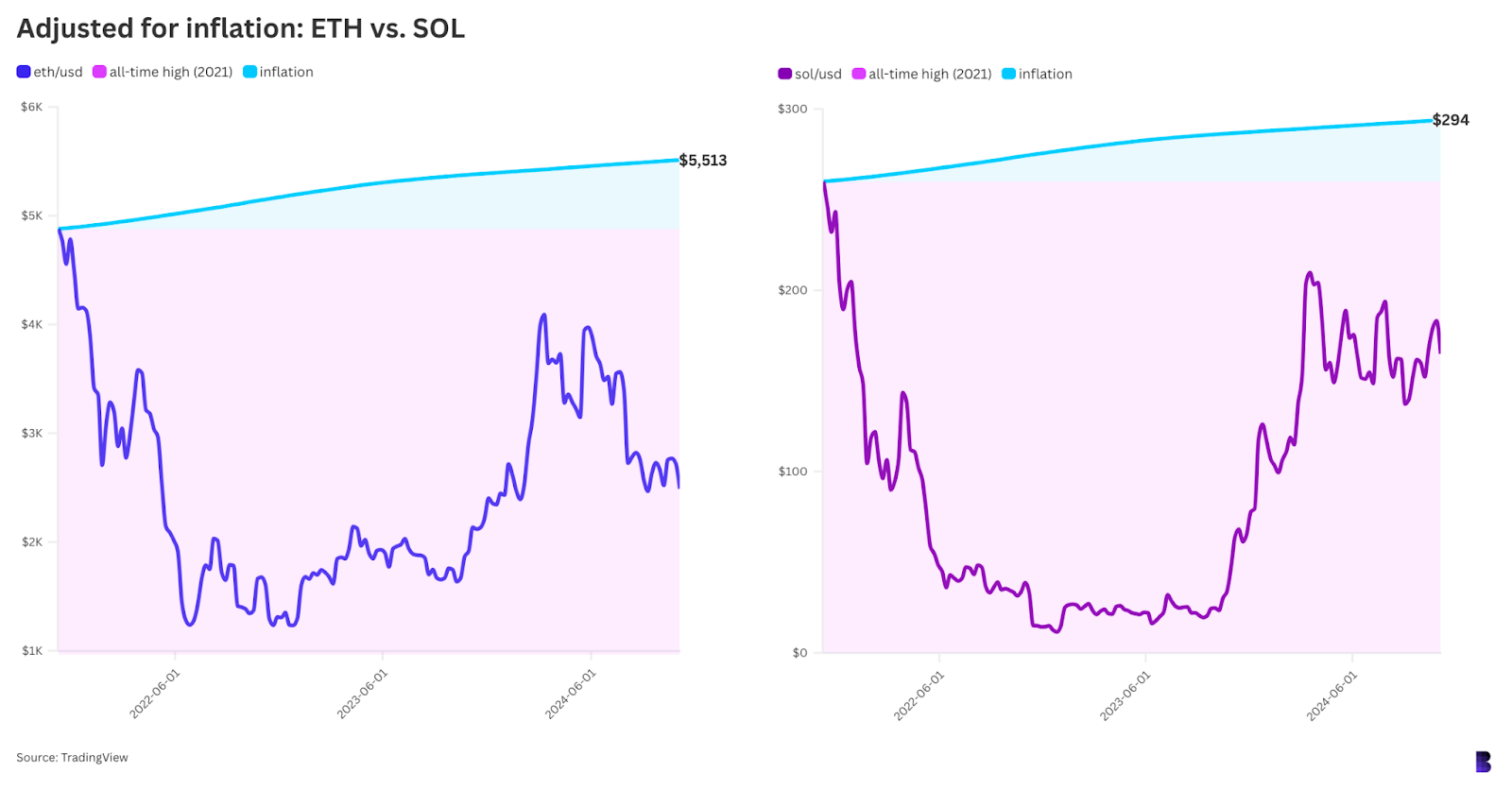

Similar trends apply to ether and solana. Ether (ETH) at $2,490 is 55% below its adjusted all-time high of $5,513. To surpass its previous record in March, ETH needed to reach $5,426 but instead peaked at $4,090, marking a 22% shortfall. Solana (SOL) is currently 44% below its adjusted all-time high of $294.

The likelihood of the crypto market detaching from traditional finance to focus solely on inflation-adjusted prices appears low. However, considering inflation during periods of economic strain, such as the pandemic aftermath, remains pertinent. Ultimately, inflation diminishes the perceived value of assets, including bitcoin's all-time highs.