Bitcoin Realized Price Increases to $37,000 Amidst Market Decline

Bitcoin declined by 1.83% over the past week, dropping its market price below $97,000. Despite this decline, market sentiment remains bullish due to a 61% price increase since early October. Recent price surges have led to potentially bearish developments in the market.

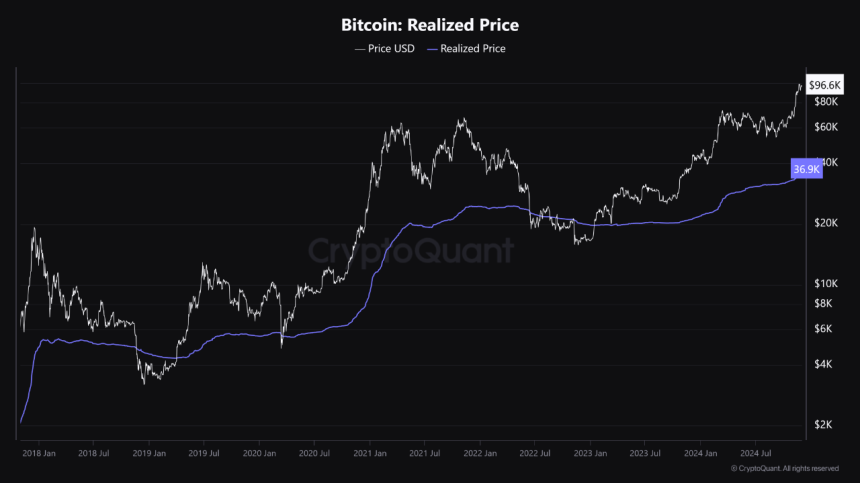

Bitcoin Realized Price Up Only $37,000 Amidst Charge To $100,000

An analyst known as Grizzly from CryptoQuant noted that Bitcoin’s realized price increased from $31,000-$32,000 to $37,000 while the market price approached $100,000. This widening gap suggests implications for market dynamics. The realized price represents the average purchase price of all circulating Bitcoin and is used to analyze investor behavior and market cycles.

A rising realized price typically indicates increased capital inflows, showing that new investors are buying Bitcoin at higher levels and reducing selling pressure from long-term holders. However, Grizzly points out that the current gap between market price and realized price may indicate short-term overheating driven by speculation without solid fundamentals. Historical data shows similar patterns during previous bull markets, suggesting that this gap may not impact Bitcoin's current bullish trend.

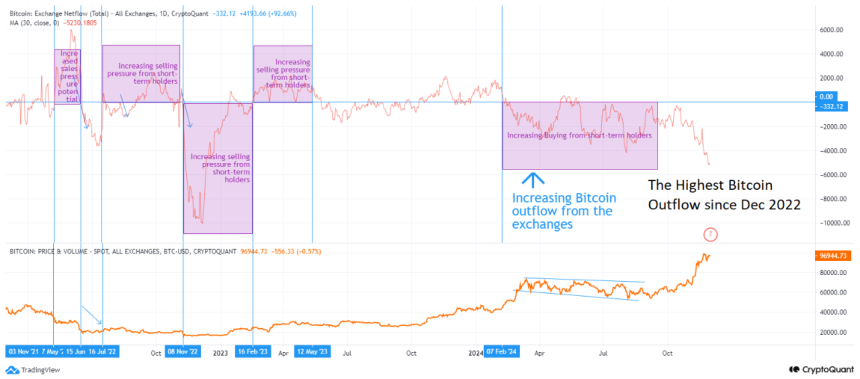

BTC Records Largest Exchange Withdrawal In Two Years

The crypto community has seen the highest Bitcoin outflow from exchanges since December 2022, indicating potential for continued bullish momentum according to the CryptoOnChain team.

As of now, Bitcoin is valued at $96,468 after a 0.08% drop in the last day. It has gained 38.22% over the past thirty days. With a market cap of $1.91 trillion, Bitcoin constitutes 55.9% of the total cryptocurrency market.