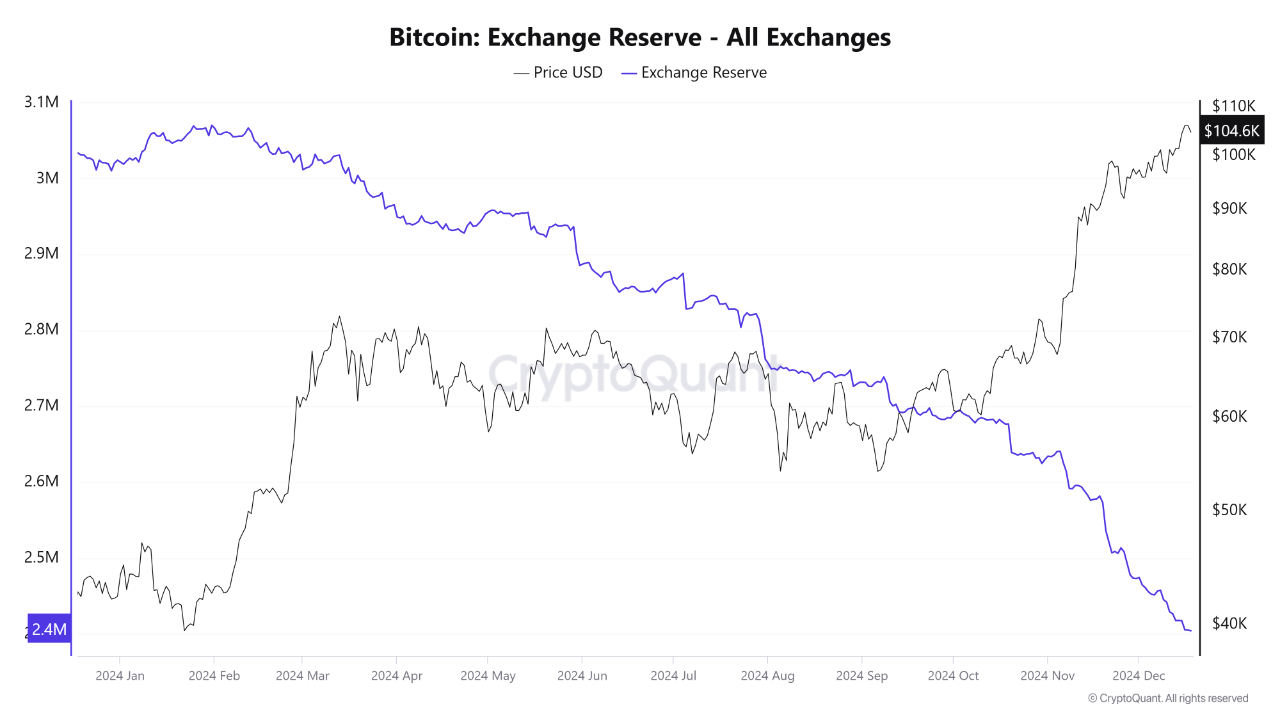

Bitcoin Exchange Reserves Drop to Historic Low of 2.4 Million

Bitcoin has experienced sustained bullish momentum, reaching new highs. Recent analysis suggests this trend is influenced by significant shifts in supply dynamics.

Current data shows Bitcoin reserves have dropped to a historic low of 2.4 million, indicating a "supply shock" that aligns with rising prices. This decline in exchange reserves, combined with strong demand, fosters an environment conducive to further price increases.

A Supply Shock In The Making

Analyst Kripto Baykus from CryptoQuant noted that Bitcoin reserves started the year at approximately 3 million on exchanges. A consistent decline throughout 2024 reflects changing investor behavior, particularly among institutional investors who are adopting long-term holding strategies by withdrawing assets from exchanges.

Baykus emphasized this shift demonstrates growing confidence in Bitcoin's future. Bitcoin's price increased from around $40,000 at the start of the year to surpass $100,000 in November, peaking above $104,000. Baykus stated:

The limited supply of Bitcoin, combined with shrinking reserves, is seen as a strong bullish signal for the market. If the trend persists, Bitcoin is likely to break further records in late 2024 and into 2025.

Bitcoin Current Demand Stance

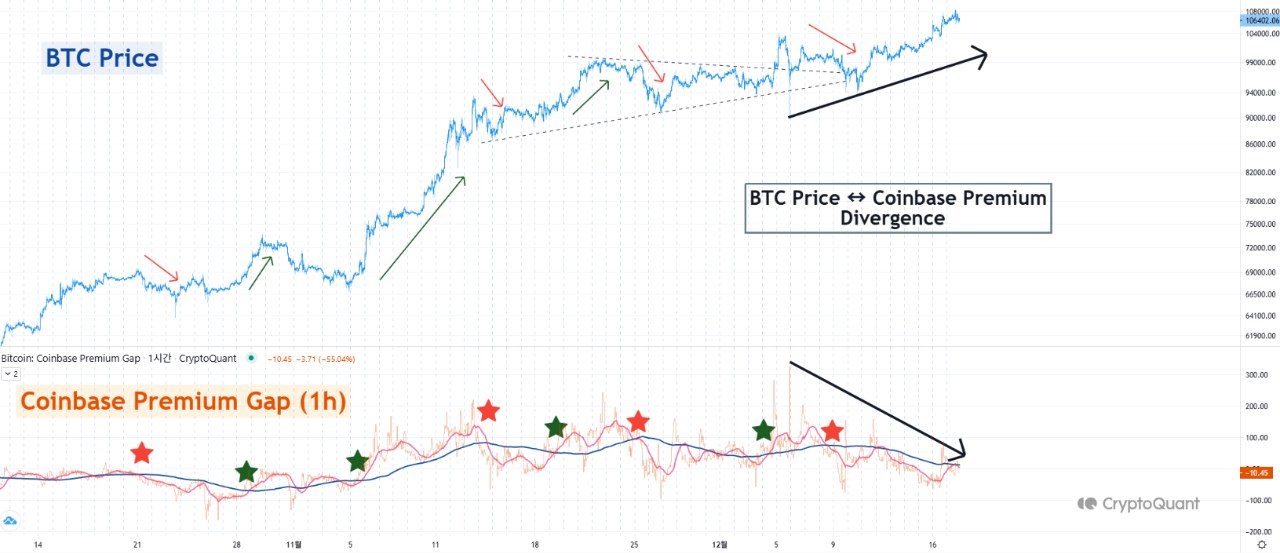

Another analyst, Yonsei Dent, examined the Coinbase Premium Index to assess Bitcoin's demand in North America. This metric tracks activity on Coinbase, a major exchange, traditionally used to predict short-term price movements. However, a recent divergence between the Coinbase Premium Index and Bitcoin’s price has raised concerns.

Dent noted that despite Bitcoin’s price increase from $94,000 to $106,000, the Coinbase Premium has declined, suggesting that U.S.-based demand may not be driving the recent surge, which could indicate potential weakness in medium-term upward momentum. He advised caution in monitoring these developments closely.

Featured image created with DALL-E, Chart from TradingView