Bitcoin Reserves Increase by 20,000 BTC Amid Short-Term Volatility

Analysts from CryptoQuant indicate that current Bitcoin (BTC) metrics suggest potential market changes.

Bitcoin Price Faces Short-Term Volatility

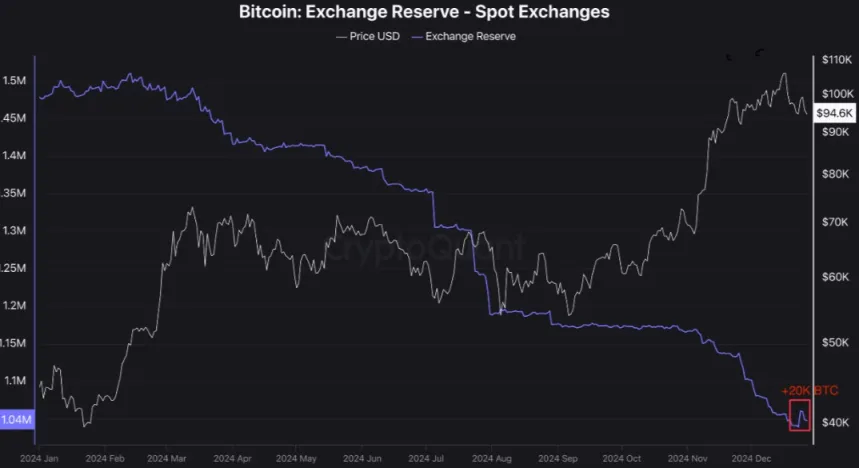

Spot exchange reserves have increased significantly, with an inflow of 20,000 BTC. This uptick indicates more Bitcoin is being deposited into exchanges, typically signaling intentions to trade or sell. The Bitcoin price has decreased nearly 7% over the past two weeks, indicating possible short-term volatility.

Netflows across exchanges have also turned positive, showing a net increase of 15,800 BTC. This shift suggests that inflows to exchanges are now surpassing outflows, which may lead to increased trading activity or profit-taking by investors. While the overall market trend favors accumulation and self-custody, these recent changes may indicate investor caution in preparation for potential profit-taking or price corrections.

A report by Bloomberg notes a key metric measuring investor interest in Bitcoin from South Korea has reached a four-month high amid political instability.

Trading Volumes Surge As Political Crisis Unfolds

The "Kimchi Premium," reflecting the price difference between Bitcoin on South Korean exchange Upbit and Coinbase, has risen to 3-5%, indicating increased demand from South Korean investors. Recent political turmoil, including President Yoon Suk Yeol's brief declaration of martial law and subsequent impeachment actions, has contributed to this situation.

These upheavals have impacted financial markets alongside economic challenges and threats from North Korea. The South Korean won has declined by 0.35% against the US dollar.

Bloomberg highlights South Korea as a highly active retail cryptocurrency market, where trading volumes on local exchanges often exceed those of traditional stock markets. Ki Young Ju, CEO of CryptoQuant, notes that corporate accounts are not allowed on Korean crypto exchanges, leading to predominantly retail-driven activity.

The Kimchi Premium serves as a key indicator of retail interest in cryptocurrencies, influenced by strict currency controls and anti-money laundering regulations.

Currently, BTC is priced at $93,938, reflecting a 2.5% decrease over the last 24 hours, with a support level at $92,000 preventing further declines.

Featured image from DALL-E, chart from TradingView.com