4 March 2025

3 0

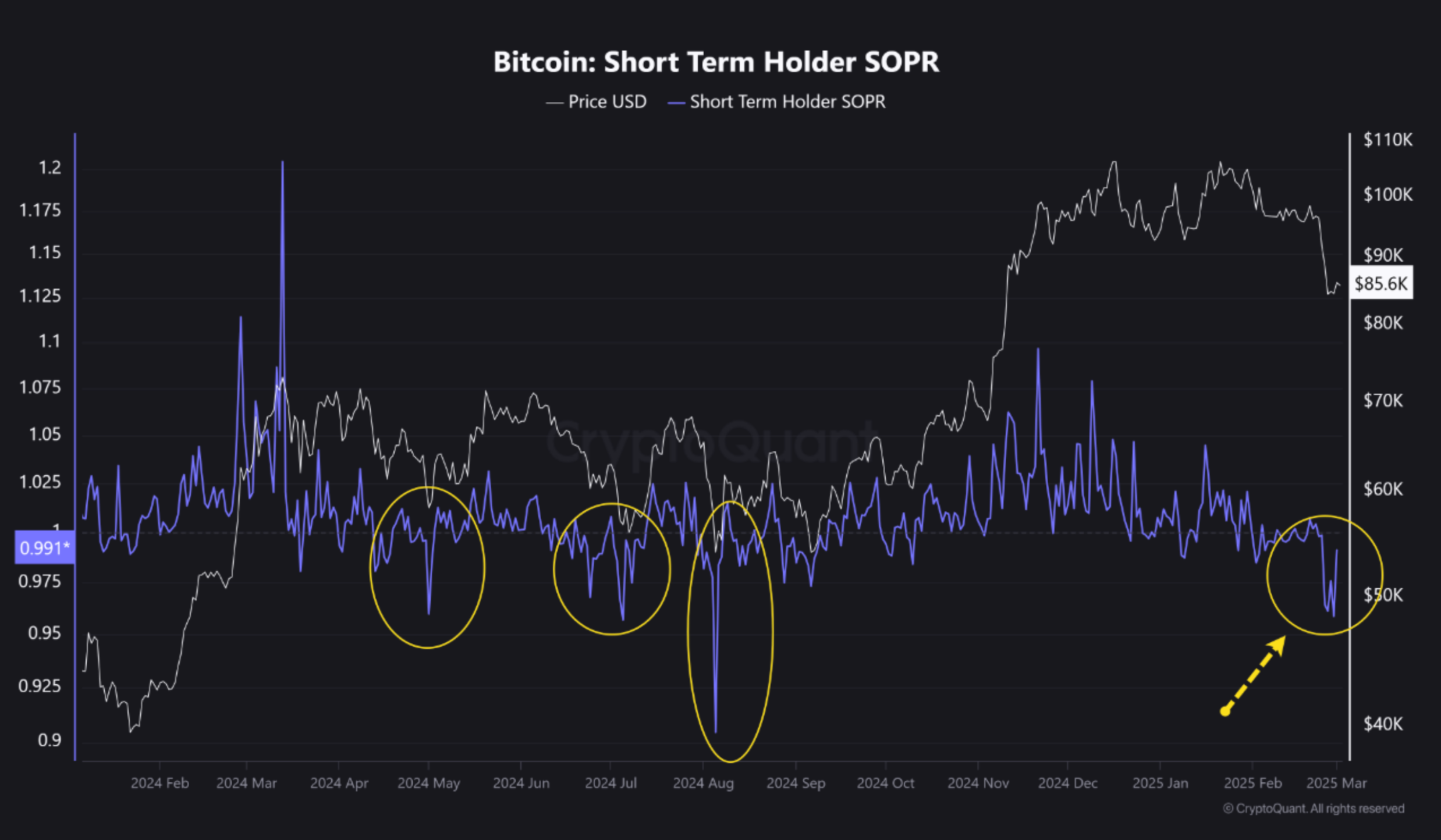

Bitcoin SOPR Falls to 0.95 Indicating Short-Term Losses

Short-term investors in Bitcoin (BTC) are currently facing losses, suggesting a potential market bottom and possible trend reversal. Key points include:

- BTC fell from $96,000 on February 23 to $78,258 on February 27 but rebounded to $95,000 recently.

- The Spent Output Profit Ratio (SOPR) for BTC is at 0.95, indicating more short-term investors are selling at a loss, the lowest since August 2024.

- The total crypto market cap increased by over $200 billion, partly due to US President Donald Trump’s announcement of a crypto reserve.

Indicators hint at a trend reversal:

- BTC partially filled a CME gap between $78,000 and $80,000, often associated with price reversals.

- Analyst Ali Martinez noted BTC is at its most oversold level since August 2024, indicating declining selling pressure.

- Andre Dragosch highlighted a contrarian buy signal for BTC despite recent pullbacks.

- Geoff Kendrick from Standard Chartered anticipates further downside before a bullish recovery.

As of now, BTC is trading at $89,826, up 5.3% in the last 24 hours.