5 0

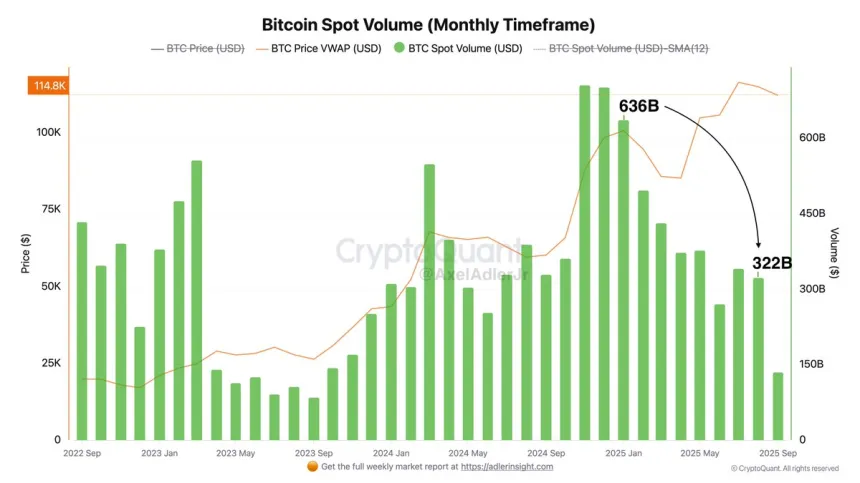

Bitcoin Spot Trading Volumes Halve to $322B as Market HODLs

Bitcoin Market Overview

- Bitcoin is trading near $114,987, with key support levels at the 50-day SMA ($114,399) and 100-day SMA ($112,681).

- Resistance is observed at $116,000–$117,000, with a successful breakout potentially leading to a retest of the cycle high at $123,217.

- Support is around $112,500; a break below could risk revisiting $110,000.

Current Market Dynamics

- Bulls are defending key supports but struggle to create new upward momentum.

- The US Federal Reserve's interest rate decision on Wednesday is anticipated, with a potential 25-basis-point cut expected.

- CryptoQuant data indicates Bitcoin is moving into "HODL mode," with supply shifting from exchanges to long-term storage.

Market Behavior & Trends

- In January 2025, spot trading volumes peaked at $636 billion, dropping to $322 billion by August, suggesting a shift towards long-term holding.

- This reduction in active speculation leads to price stability but may result in sharper swings due to thin liquidity.

The combination of macroeconomic factors and on-chain fundamentals will likely influence Bitcoin's performance this week. The Fed's decision might serve as a catalyst for renewed market momentum if Bitcoin maintains its position above critical levels.