Bitcoin Holds Steady Above $88,000 Amid Active LTH Distribution

Bitcoin (BTC) remains above $88,000, demonstrating resilience as the market anticipates its next move. Price action is strong, frustrating investors seeking lower entry points.

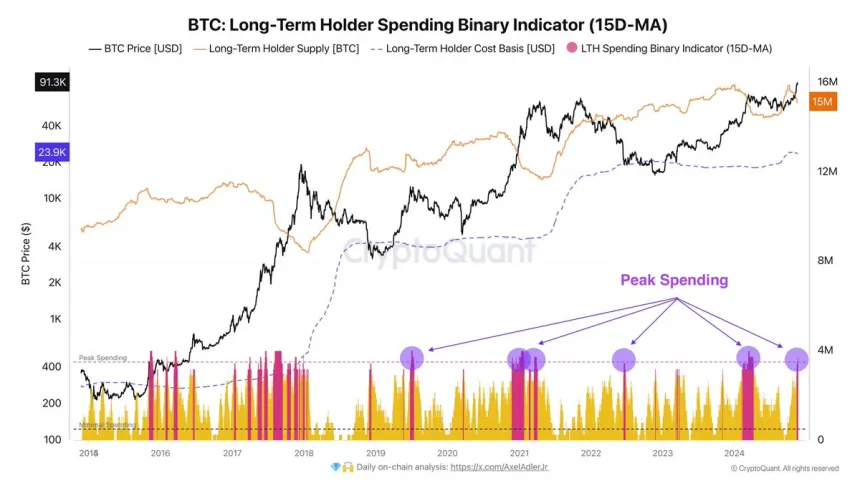

Data from CryptoQuant indicates that long-term holders (LTHs) are in an active distribution phase, leading to increased selling activity. Despite this, the market has absorbed the additional supply without significant price impact, reflecting strong demand for BTC at current levels.

As Bitcoin consolidates below its all-time highs, traders monitor whether momentum will lead to a breakout or retracement. The balance between rising demand and LTH distribution will influence BTC's near-term trajectory.

Can Bitcoin Set New ATH This Week?

Bitcoin is close to breaking its all-time high (ATH), currently 2% below the $93,483 level set last Wednesday. Analysts and investors are observing BTC’s price action, weighing the likelihood of surpassing this critical threshold or entering prolonged consolidation.

While bullish momentum is strong, sideways movement could keep the price range-bound before any significant shift.

CryptoQuant analyst Axel Adler notes that LTHs are in an active distribution phase. Increased supply has not significantly affected Bitcoin’s price due to strong demand absorbing selling pressure, indicating robust market interest near record highs.

Adler’s analysis highlights the LTH Spending Binary Indicator, signaling peak spending among LTHs. Concurrently, the growing LTH supply suggests confidence in BTC’s future price potential. This dynamic allows high demand to offset distribution, maintaining bullish momentum.

As Bitcoin approaches its ATH, market participants await clarity on whether the price will breach new territory or consolidate further. The outcome will likely define BTC's trajectory in the coming weeks.

BTC Price Action: Key Levels To Hold

Bitcoin is trading at $91,820 after several days of sideways consolidation just below its ATH. BTC has held above the $87,000 support level since the last breakout, marking it as a critical line for bulls to defend. Maintaining this level is essential for sustaining upward momentum towards new highs.

A drop below $87,000 could shift market sentiment, potentially triggering a correction as BTC seeks fresh demand. The next support zone is around $80,000, with deeper pullbacks possible if selling pressure increases. Such a retrace could attract sidelined buyers but may temporarily stall BTC’s rally.

Bitcoin's robust price action is driven by demand outpacing supply, mitigating profit-taking and selling effects, and preserving the broader uptrend.

As BTC consolidates near its ATH, traders watch key levels to determine whether the next move will be a breakout to new highs or a dip to test lower support zones. Each outcome will shape Bitcoin’s trajectory in the upcoming weeks.

Featured image from Dall-E, chart from TradingView