4 0

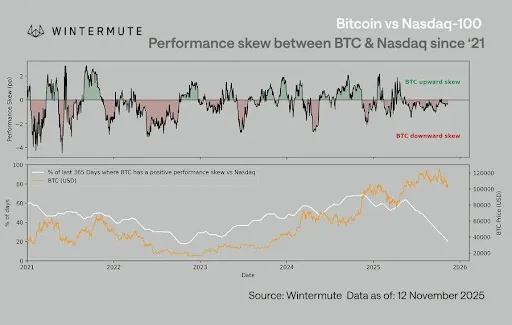

Bitcoin Maintains Strength Despite Negative Market Correlation Challenges

Bitcoin is demonstrating resilience amidst negative market correlations, particularly with the Nasdaq. It responds more to declines than rises, a pattern typical near macro bottoms rather than cycle tops.

- Bitcoin has hit multiple all-time highs this year, currently trading about 25% below its peak.

- The Fear and Greed Index is at 14 out of 100, similar to levels before past significant downturns.

- The sentiment suggests patience as a profitable strategy despite simultaneous crashes in the broader crypto market and BTC.

Trend Reversal and Support Zones

- Bitcoin approaches two major liquidity pockets expected to act as short-term support.

- There is a heavy cluster of long liquidations between $80,000 and $90,000.

- A CME true gap exists between $92,000 and $92,500, indicating potential price movements.

- Bitcoin broke below the weekly supertrend and EMA50, remaining in a correction phase.

- The $90,000 level is identified as a potential bounce zone for a breakout or further decline toward the mid-$80,000 range.