Bitcoin Surges Above $100,000 Mark with 4.5% Increase

After trading below $100,000 for weeks, Bitcoin has begun 2025 with renewed bullish momentum. The cryptocurrency, previously struggling, recently climbed above the psychological $100,000 threshold.

Bitcoin started the year trading between $93,000 and $95,000 but is now at $102,368, marking a 4.5% increase in the past 24 hours and nearing its all-time high of $108,000 from late 2024.

This upward trend has reignited interest among retail and institutional investors, who are monitoring key market indicators for signs of sustainability or potential corrections.

What Bitcoin Short-Term Holder Realized Price Indicates

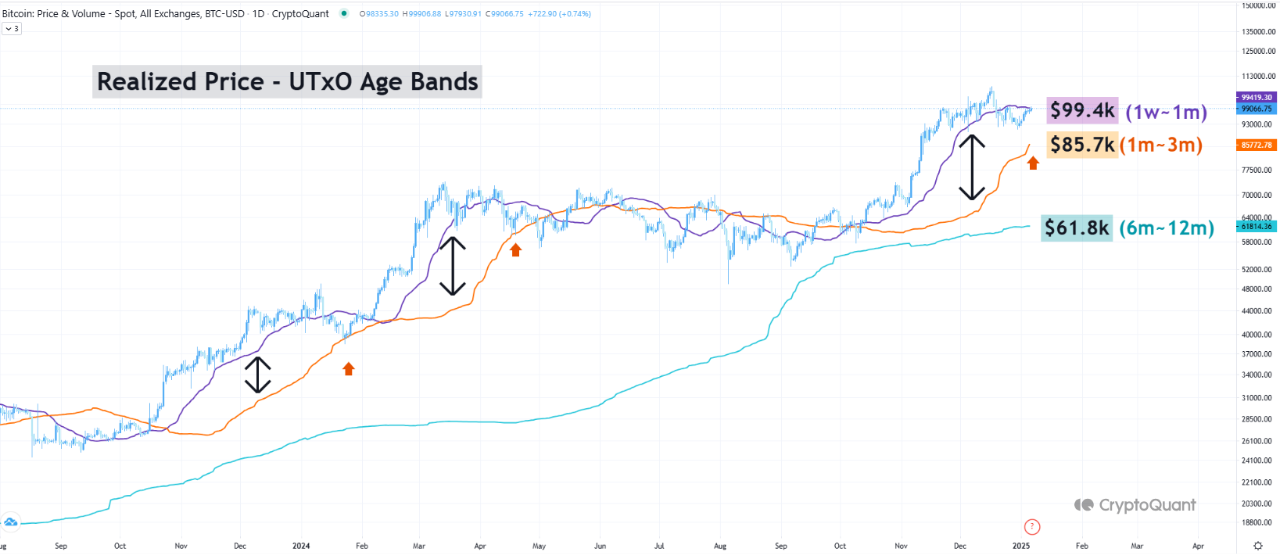

CryptoQuant analyst Yonsei Dent shared an analysis focusing on the Realized Price of Short-Term Holders (STH) as a critical breakeven point.

The Realized Price reflects the average purchase price of Bitcoin by short-term holders, divided into two bands: 1-week to 1-month (1W-1M) and 1-month to 3-month (1M-3M).

Historically, the 1M-3M band serves as medium-term support, while the 1W-1M band indicates short-term sentiment. A widening gap often leads to consolidation or corrections until convergence occurs.

Currently, Bitcoin faces resistance at the 1W-1M band, while the 1M-3M band provides strong support, indicating a potential accumulation opportunity for medium-term investors.

Dent emphasized the importance of monitoring these bands to identify market trends. As they converge, Bitcoin may experience stability before determining its next significant price movement.

Further Upward Momentum Expected?

Analyst Joohyun Ryu from CryptoQuant provided insights regarding Bitcoin's recent correction phase. Despite signs of market cooling, key indicators suggest a potential rebound.

Metrics such as Market Value to Realized Value (MVRV), Adjusted Spent Output Profit Ratio (aSOPR), and Net Unrealized Profit/Loss (NUPL) provide context for assessing market sentiment.

The MVRV ratio is currently at 2.358, indicating a moderate premium compared to realized value. The aSOPR metric stands at 1.02, suggesting that Bitcoin transactions are yielding profits on average.

The NUPL value of 0.58 reflects ongoing optimism in market sentiment despite fluctuations. Ryu noted continued activity from short-term holders, indicating their consistent market participation amidst volatility.

This influx of new investors suggests growing confidence in Bitcoin’s long-term value, historically preceding significant price increases and reinforcing expectations for a potential breakout following the recent cooling phase.

Featured image Created With DALL-E, Chart from TradingView