Bitcoin Surpasses $102,000 Mark with $200 Million in Liquidations

Bitcoin (BTC) has surpassed the $102,000 price level, achieving a market valuation of $2 trillion. Currently trading at $102,435.34, BTC experienced a 4.25% increase in the last 24 hours. This marks the first time since December 18th that Bitcoin has exceeded $102,000.

Market data indicates that $131.71 million in BTC short positions were liquidated within 24 hours, compared to $67 million in long positions. In the last 12 hours, $129.26 million was liquidated, with $38.13 million in longs and $91.13 million in shorts.

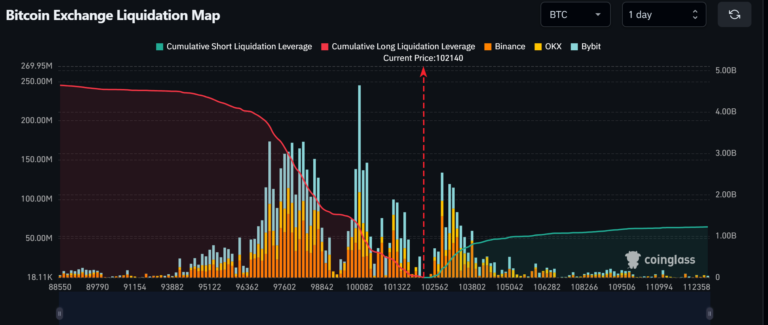

The Bitcoin exchange liquidation heat map shows that if Bitcoin rises above $106,000, approximately $1.01 billion in BTC shorts will be liquidated. Conversely, if it drops below $100,000, $1.35 billion in BTC longs will be wiped out, and a decline to $96,000 could lead to $4.10 billion being erased.

Bitcoin exchange liquidation – Source: Coinglass

Diving Deeper Into Bitcoin Price Rally

Bitcoin reporter Vivek noted on X (formerly Twitter) that the supply of Bitcoin on exchanges has reached an all-time low, indicating users have withdrawn funds to hardware wallets for long-term holding. He anticipates an incoming "supply shock," which may propel Bitcoin towards a new all-time high.

#Bitcoin balance on exchanges hits an all time low.

Supply shock incoming 🚀 pic.twitter.com/BkEmFfWeE7

— Vivek⚡️ (@Vivek4real_) January 6, 2025

According to CoinMarketCap data, Bitcoin's current all-time high is $108,000, achieved over 20 days ago. If bullish momentum continues around Trump's inaugural day and US spot BTC exchange-traded funds see increased inflows, BTC may reach a new ATH before January 20th.

Bitcoin Price Analysis

The Relative Strength Index (RSI) for Bitcoin reads 62.6, indicating bullish control over the price action. The gradient suggests that higher prices are likely, with significant potential for BTC to continue its ascent towards $110,000.

Bitcoin price – Source: TradingView