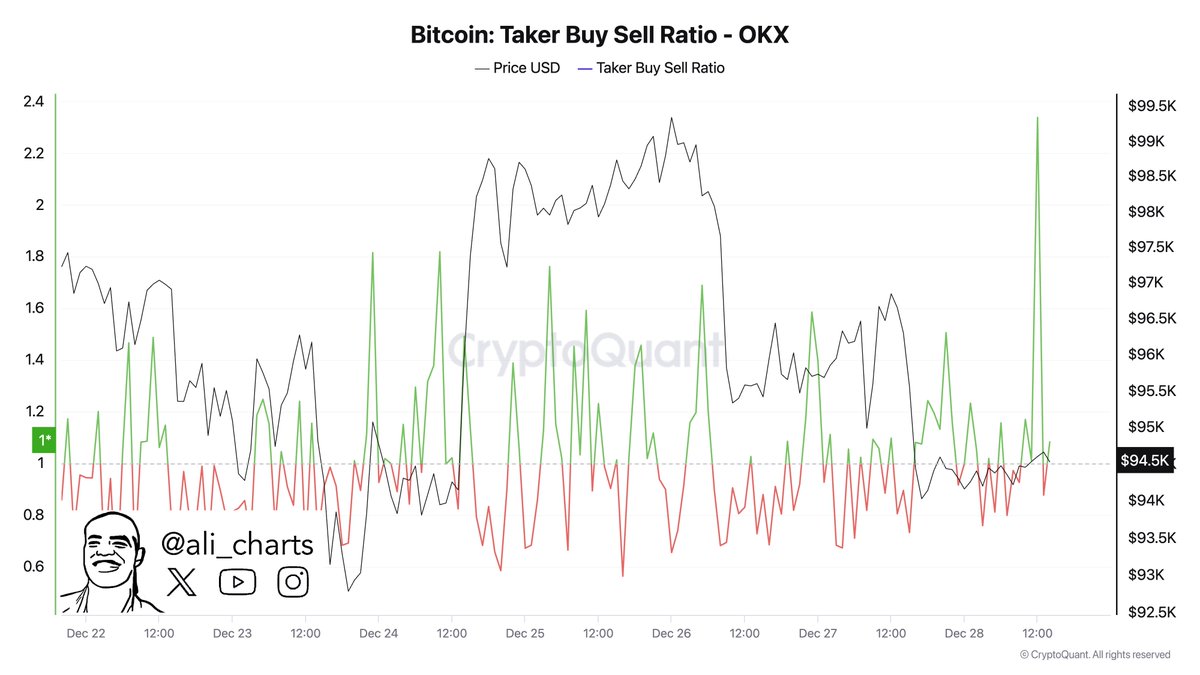

Bitcoin Taker Buy/Sell Ratio Hits 2.3, Indicating Increased Buying Pressure

Bitcoin's price has experienced slight consolidation over the past week, struggling to surpass $100,000 on Christmas day. Investors anticipate a potential rally before the end of 2024, supported by recent on-chain signals.

Can Increased Buying Pressure Push Bitcoin Price Back Toward $100,000?

On December 28th, analyst Ali Martinez shared insights regarding the "taker buy/sell ratio," an indicator measuring taker buy and sell volumes for Bitcoin. A ratio greater than one indicates higher buying activity, suggesting bullish sentiment as investors are willing to pay more for Bitcoin. Conversely, a ratio below one indicates greater selling pressure and bearish sentiment.

Martinez noted that the Bitcoin taker buy/sell ratio on the OKX exchange spiked to 2.3 on December 28, indicating increased buying activity. This trend could lead to upward momentum in Bitcoin's price, which currently sits just below $95,000, reflecting a 0.6% increase in the last day.

BTC Continues To Flow Out Of Exchanges

A pseudonymous analyst on CryptoQuant reported a significant decline in Bitcoin flowing into exchanges, correlating with a low Netflow-to-Reserve ratio. This negative ratio indicates that investors prefer to hold their Bitcoin rather than sell for profits, presenting a bullish signal for future price growth.