4 0

Bitcoin Traders Anticipate Weak Performance as ‘Sell in May’ Approaches

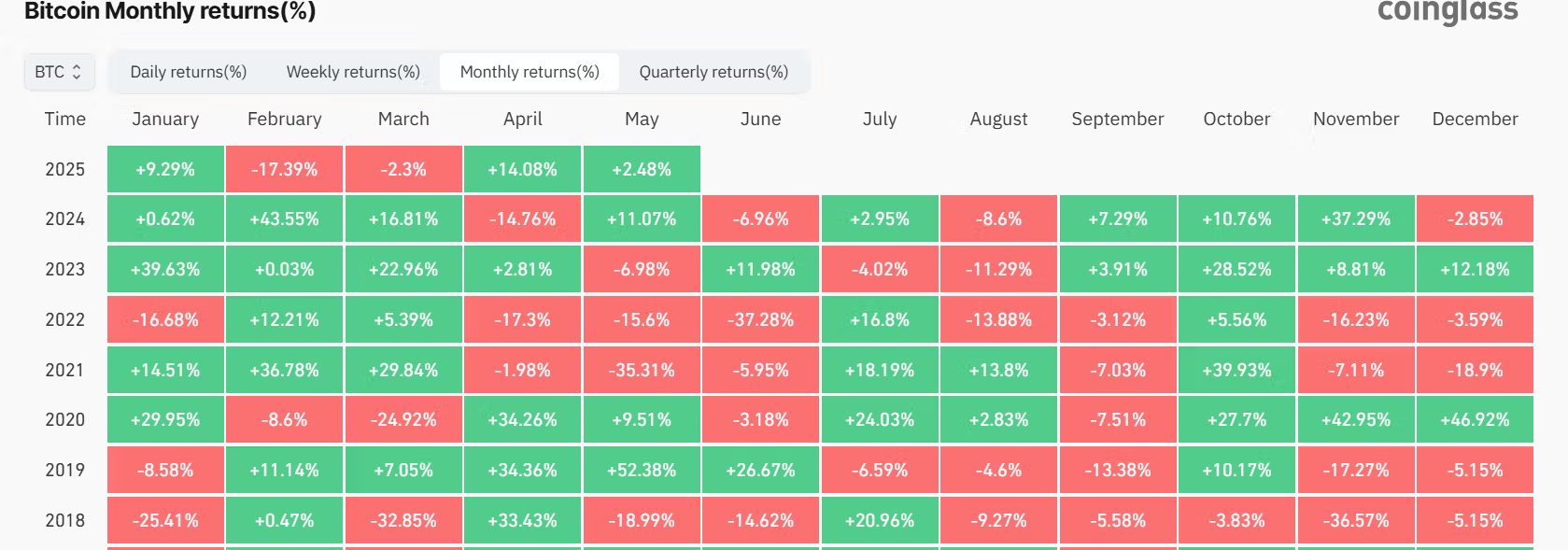

Bitcoin (BTC) has recently shown a breakout, prompting speculation about reaching the $100,000 level. However, traders are cautious as May approaches, a month historically associated with weaker market performance.

- Jeff Mei from BTSE noted that the “Sell in May and Walk Away” adage often reflects seasonal trends in financial markets.

- This year, Bitcoin could defy previous trends, potentially reaching $97,000, despite weak GDP numbers indicating recession risks.

- Historical data shows U.S. stock markets underperform from May to October compared to November to April, a pattern some investors follow.

- Recent BTC performance in May has been mixed:

- 2021: -35%

- 2022: -15%

- 2023: Flat or mildly positive

- Red months in May often lead to declines in June, with four of the last five Junes ending negatively.

- Traders may exhibit caution due to historical seasonality and fading momentum after strong Q1 rallies.

- Average gains for the S&P 500 from May to October have been only 1.8%, contrasting with stronger returns from November to April.

- BTC's average return in Q2 is 26%, but the median is just 7.5%, highlighting volatility.

- Q3 typically sees lower average returns at 6% and slight negative medians.

- Historically, Q4 represents Bitcoin’s strongest period with an average return of +85.4%.

Market psychology may respond to seasonal narratives, and the "Sell in May" trend could impact investor sentiment.