Bitcoin Records First Weekly Close Above $100,000 Amidst Correction Concerns

Bitcoin (BTC) closed the week above $100,000 for the first time in history. Market analysts caution that historical patterns may signal an impending correction.

Bitcoin First Weekly Close Above $100,000

BTC achieved the $100,000 milestone nearly a week ago, marking a significant psychological barrier. Following this achievement, Bitcoin experienced its largest retracement since the 2016 US presidential election, dropping approximately 13% to around $90,000. Currently, BTC fluctuates between $97,000 and $101,000, facing resistance at the upper range.

Crypto analyst Jelle indicated that BTC might replicate its behavior after crossing the $10,000 threshold, potentially turning this new level into support after several days, similar to November 2017.

After four days within this range, Bitcoin recorded its first daily close above $100,000 on Sunday, achieving its first weekly close above this level, akin to its performance during the $10,000 breakout.

Analyst Rekt Capital noted that BTC's daily close above $100,000, followed by a 2.5% pullback, serves as a “technical retest” of this level. However, the ongoing volatility complicates efforts to establish the $98,000 zone as support.

Rekt Capital explained that the current retest is expected to be volatile, with the aim of confirming the $98,000 level as new support following its breach as resistance.

Will The Next Few Weeks Be ‘Problematic’ For BTC?

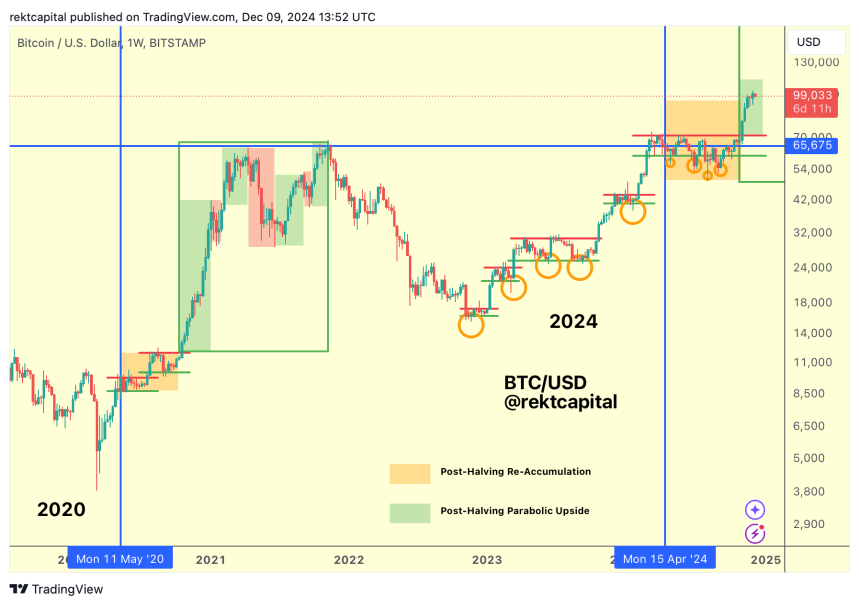

Despite surpassing the crucial $100,000 barrier, Rekt Capital warned that BTC may face challenges in the upcoming weeks due to its post-halving “Parabolic Upside Phase.” Historically, BTC enters a parabolic period lasting around 300 days after each halving event.

Typically, BTC experiences its first major pullback about a month into price discovery mode. Analysts note that the first “Price Discovery Correction” often occurs between Weeks 6 and 8 of the parabolic phase, with retracements of at least 25% expected.

Currently in the sixth week of this phase, Rekt Capital emphasized that significant retracements are common. Bitcoin's price could decline between 25% and 40% in the coming weeks, reminiscent of trends observed in 2017.

The analyst stressed the importance of maintaining the $98,000 level; failure to do so may trigger a major correction:

Over the next three weeks, I will be increasingly cautious regarding retest attempts, and based on BTC’s historical behavior at this cycle point, key levels could be invalidated.

However, he stated that following any potential correction, a second price discovery uptrend could lead BTC to a new all-time high.

At present, Bitcoin is trading at $98,073, reflecting a 2% decrease over the past 24 hours.