Bitcoin Whale Moves 8,000 BTC Aged 5-7 Years Amid Market Stagnation

Bitcoin struggles with the $100,000 resistance after a decline from its all-time highs. Analysts and investors are monitoring the situation for signs of either a rally or a correction.

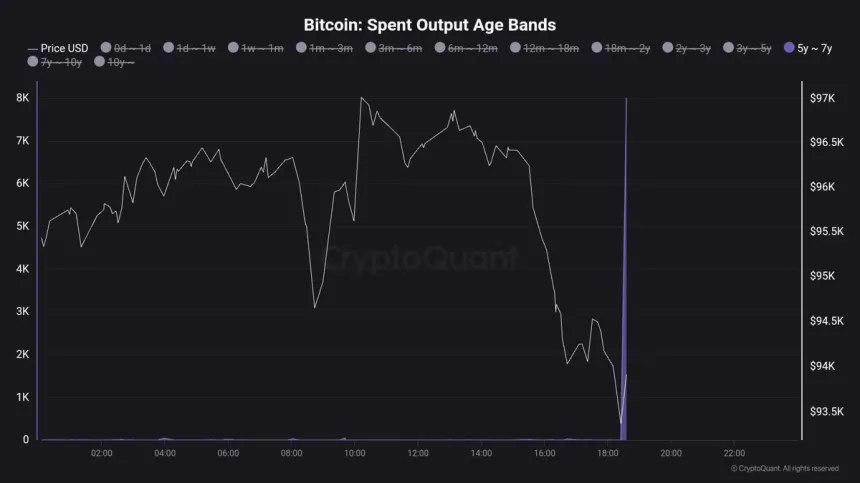

Renowned analyst Maartunn noted that over 8,000 BTC, aged between five and seven years, have moved on-chain, raising concerns about long-term holders' intentions. Such movements historically precede market shifts, often indicating increased selling pressure.

This activity suggests waning confidence or profit-taking, keeping Bitcoin below the $100K threshold. The ongoing battle between bulls and bears highlights growing uncertainty regarding whether this level will become support or initiate a downward trend.

Smart Money Moving Bitcoin

Since early December, Bitcoin has been in a consolidation phase, with whale activity significantly influencing price suppression. Maartunn reported that an old Bitcoin whale has resumed making substantial moves, affecting market dynamics.

The movement of over 8,000 BTC reflects patterns seen previously, where the same whale shifted more than 72,000 BTC since consolidation began. This "smart money" indicates strategic positioning rather than impulsive selling.

If this whale continues to offload BTC, selling pressure could keep Bitcoin below key psychological levels, prolonging consolidation. However, this phase may set the stage for a significant rally once the activity decreases.

Analysts view this as a preparation period by seasoned participants, suggesting that Bitcoin might experience a powerful upward breakout when the situation stabilizes.

BTC Above Key Demand Level

Bitcoin is trading at $95,000, maintaining above the critical $92,000 support level. Despite bearish control in recent weeks, the market has not breached the demand zones at $92,000 and $90,000, indicating resilience among buyers.

Defending these levels could facilitate a challenge to the all-time high (ATH). Holding above $92,000 would bolster bullish sentiment and attract interest from traders and institutional investors focused on the $100,000 milestone.

A failed attempt to reclaim $100,000 may indicate buyer exhaustion, potentially leading to a deeper correction and revisiting lower support zones as strategies are reassessed.

The upcoming weeks are crucial for Bitcoin's trajectory. Its ability to maintain key levels and overcome psychological barriers will determine whether it rallies or retraces significantly.

Featured image from Dall-E, chart from TradingView