10 1

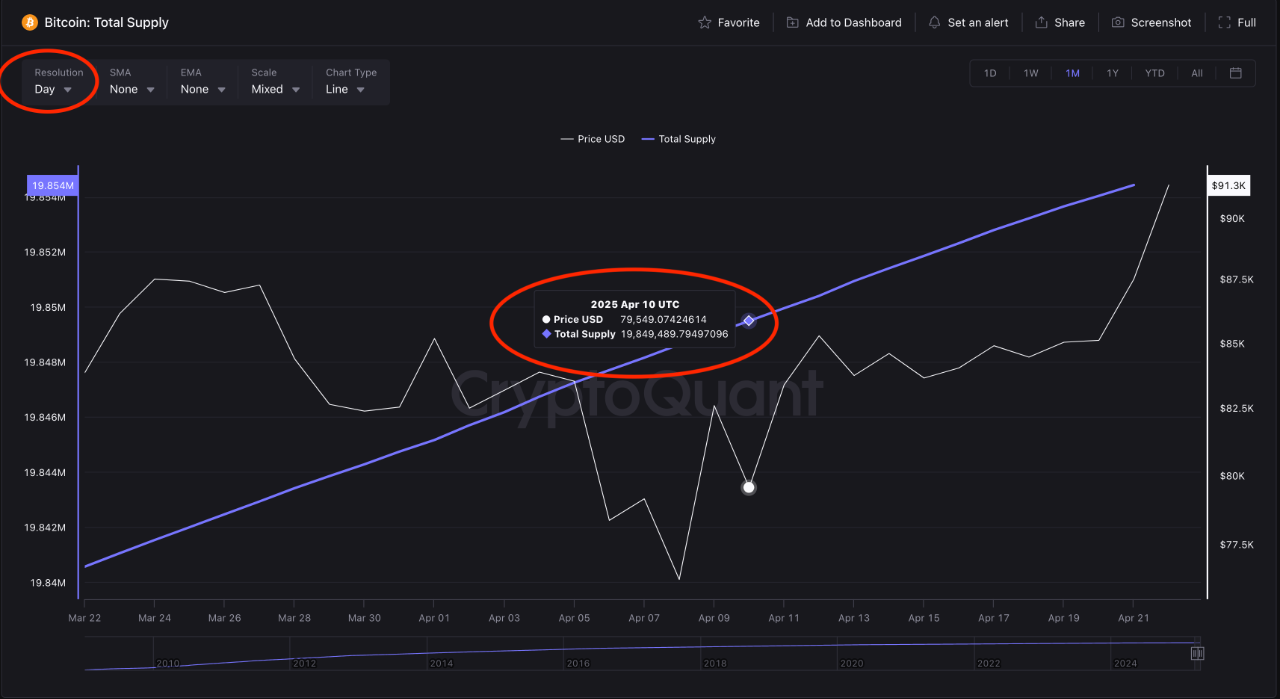

Bitcoin’s Actual Supply Lower Than Expected Post-Halving Analysis

Bitcoin has regained ground, trading above $93,000 and currently priced at $94,014. This reflects a 5% increase in 24 hours and over 20% in two weeks after dropping to $74,000 earlier this month.

Post-Halving Emission Rates Deviate From Theoretical Output

Carmelo Alemán from CryptoQuant provided insights into Bitcoin's mining dynamics post-Halving. Key points include:

- Bitcoin's block schedule indicates one block mined every 10 minutes.

- Post-April Halving, the block reward decreased from 6.25 BTC to 3.125 BTC.

- This should lead to about 450 BTC entering circulation daily (3.125 BTC × 144 blocks).

- Alemán found actual newly mined coins often fall below this theoretical estimate.

Discrepancies may arise from slower block times, network difficulty adjustments, or congestion within the mining ecosystem.

Bitcoin On-Chain Metrics Offer Real-Time Supply Monitoring

Alemán's findings highlight the importance of on-chain metrics for understanding Bitcoin supply dynamics. Key implications are:

- On-chain metrics provide real-time views of blockchain activity, enhancing market models.

- The halving event aims to limit inflation and maintain a fixed supply cap.

- Monitoring actual supply growth influences supply-demand calculations and miner profitability.