5 0

– Bitfinex cuts trading fees to zero for spot, margin, derivatives – No hidden fees added despite skepticism, multiple revenue streams cited – Competition intensifies between centralized and decentralized exchanges

Bitfinex, a well-known cryptocurrency exchange, has eliminated maker and taker trading fees across various products indefinitely to increase its market share. This applies to spot, margin, derivatives, securities, and OTC trading.

- Bitfinex plans to profit through alternative revenue streams such as withdrawal fees and specific capital markets activities.

- The zero-fee strategy aims to boost trading activity, attract new users, enhance liquidity, and increase revenue from lending and other services.

- Some skepticism exists regarding potential hidden costs; Bitfinex has denied any hidden fees.

Heightened Competition Among Crypto Exchanges

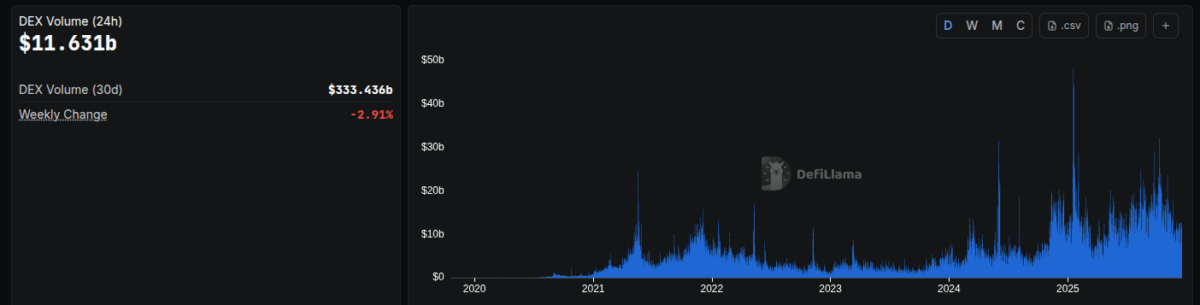

The competition between centralized exchanges (CEXs) like Bitfinex and decentralized exchanges (DEXs) is intensifying.

- Bitfinex competes with major CEXs including Binance, Coinbase, and Kraken.

- DEXs such as Uniswap and PancakeSwap are gaining popularity, with daily volumes peaking at $50 billion in January 2025 and currently at $11.63 billion.

- Centralized exchanges are adopting innovative strategies, like Kraken's launch of xStocks on the TON blockchain.

The evolving competition landscape necessitates strategic shifts by companies like Bitfinex to maintain and expand their market presence.