3 0

Bitmine Increases Ethereum Holdings to 3.16M ETH Amid Price Dip

Ethereum (ETH) is experiencing pressure, trading below $4,000 after a sharp sell-off on October 10 disrupted its summer uptrend. This decline has led to concerns about a deeper correction if key demand levels aren't defended.

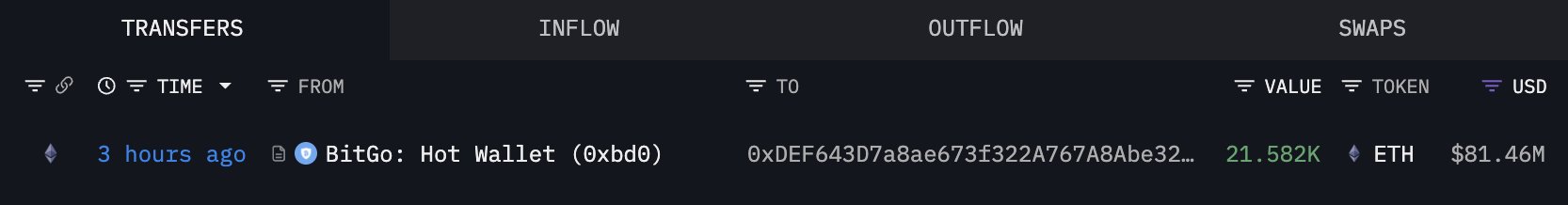

- Institutional investors continue to accumulate ETH despite the price drop. Bitmine, for example, purchased 44,036 ETH during the pullback, bringing their total holdings to approximately 3.16 million ETH, valued at $12.15 billion.

- This divergence between institutional buying and market sentiment indicates potential bullish momentum if ETH stabilizes above $4,000.

Currently, Ethereum is testing key support around $3,847. It broke below the 50-day and 100-day moving averages, signaling weakened momentum.

- If ETH loses the $3,800 support, the next demand zone is near $3,500 and the 200-day moving average at $3,200.

- Reclaiming $4,000 and $4,150–$4,200 is necessary to revive bullish momentum.

The broader bullish structure remains intact, with institutional participation and expanding Layer-2 ecosystems supporting Ethereum's long-term investment potential.