BlackRock Bitcoin ETF Records $330 Million Single-Day Outflow

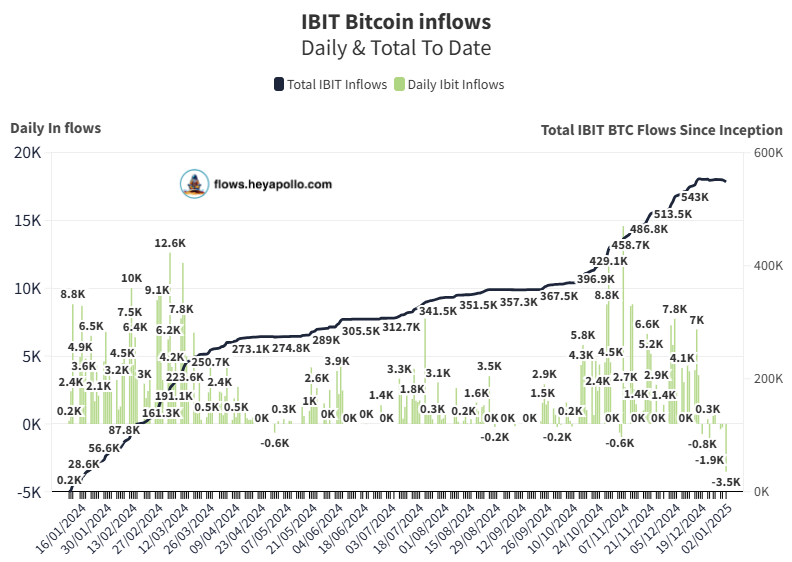

On January 2, BlackRock‘s iShares Bitcoin Trust (IBIT) experienced a record outflow of $330 million, resulting in the sale of approximately 3,510 BTC. This marks the first outflow exceeding $300 million since IBIT's launch in January 2024. Despite this, the BlackRock Bitcoin ETF has accumulated a significant $37.2 billion in inflows, with total assets under management reaching $53.7 billion as of the current BTC price.

The BlackRock Bitcoin ETF has seen three consecutive days of outflows this week, indicating that institutions are engaging in profit-taking after substantial yearly gains. Over the past week, IBIT reported $391 million in outflows.

Source: Apollo, Thomas Fahrer

While IBIT recorded $331 million in outflows on Thursday, Grayscale’s GBTC also saw $23 million in outflows. In contrast, other entities experienced net inflows during the same period: Bitwise’s BITB gained $48.3 million, Fidelity’s FBTC added $36 million, and Ark Invest’s ARKB saw $16.5 million in inflows.

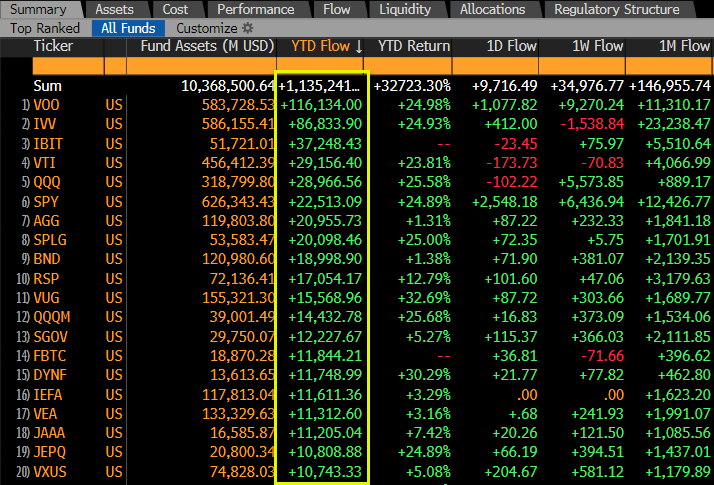

BlackRock Bitcoin ETF Ranks among Top Three

According to data from Bloomberg’s Senior ETF Strategist Eric Balchunas, the BlackRock Bitcoin ETF ranks among the top three ETF launches for 2024 based on net inflows. The Vanguard 500 Index Fund (VOO) leads with $116 billion in inflows, followed by the iShares Core S&P 500 ETF (IVV) at $89 billion.

Source: Bloomberg

Bitcoin core developer Adam Back commented that Bitcoin ETFs could potentially lead in inflows and prices in 2025. The continuation of institutional demand for IBIT in 2025 will depend on BTC price movements and market sentiment. Following its all-time high of $108,000, Bitcoin has faced selling pressure and remains below the critical support level of $95,000.

Demand for Crypto ETFs on the Rise

In addition to Bitcoin and Ethereum ETFs, there is optimism regarding the approval of additional crypto ETFs by the new SEC administration under Paul Atkins. ETF Store President Nate Geraci outlined predictions for crypto ETFs in 2025, which include combined spot BTC and Ether ETFs, spot ETH ETF options trading, in-kind creation and redemption for spot BTC and ETH ETFs, staking for spot Ether funds, and the potential approval of a spot Solana ETF.

Eric Balchunas from Bloomberg stated he does not anticipate other crypto ETF approvals before July unless the SEC accelerates the process. He noted that although several altcoin ETF approvals are being speculated, there are currently no active 19b-4 filings, and typical approval timelines extend beyond July.