13 0

BlackRock Bitcoin ETF Faces $1.78 Billion Outflow in November

The Bitcoin ETF sector in the U.S. faces challenges, with significant outflows and concerns about a potential bear market. BlackRock iShares Bitcoin Trust ETF (IBIT) saw its largest single-day withdrawal, impacting Bitcoin's price.

Market Trends

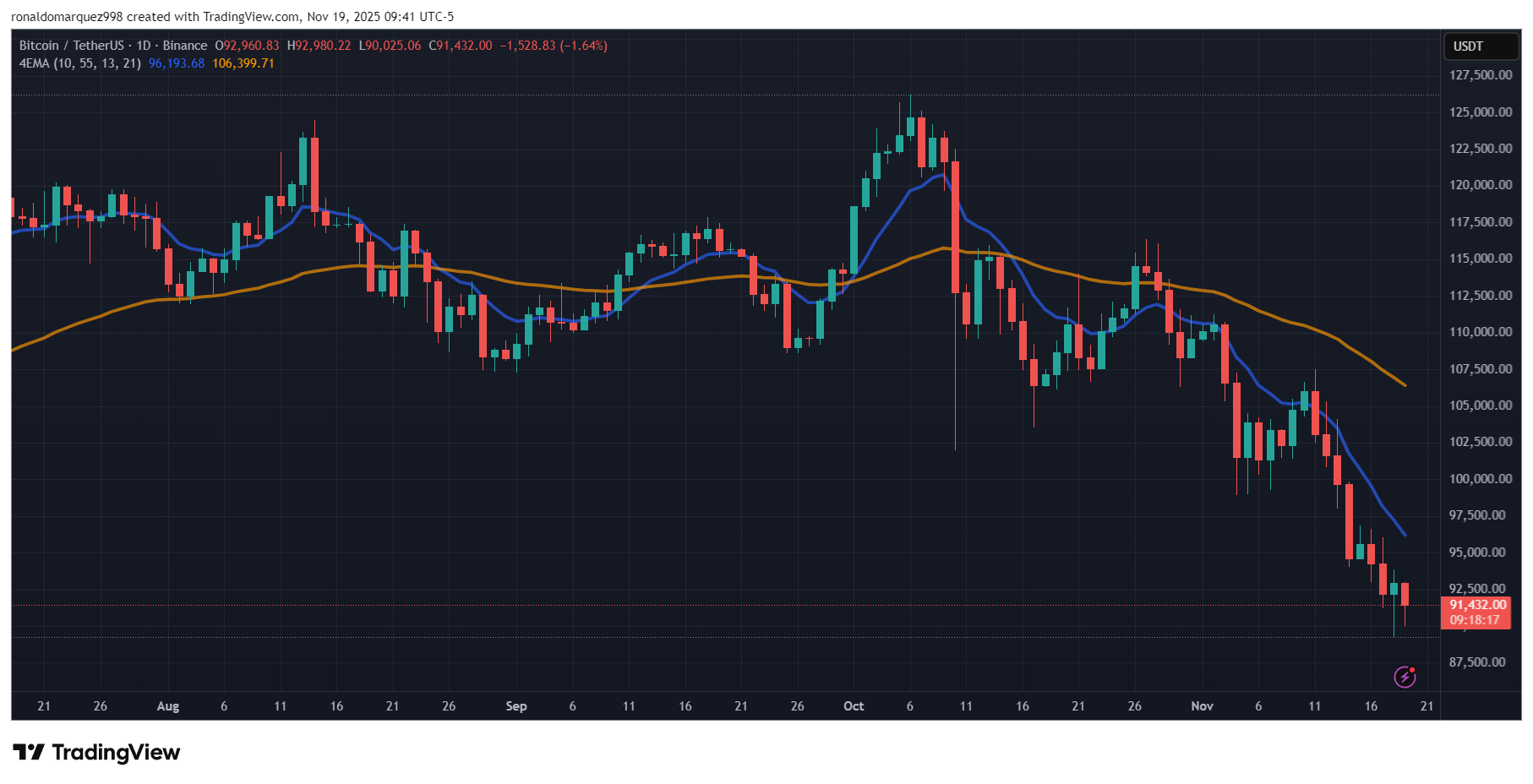

- Bitcoin recently corrected below $100,000 after reaching a record high in October.

- Investors are shifting exposure from Bitcoin to gold, which remains resilient.

- Thomas Perfumo of Kraken noted that much of the earlier demand for Bitcoin was fueled by borrowed funds.

Long-term holders are taking profits, and Bitcoin ETF funds show increased caution.

ETF Outflows

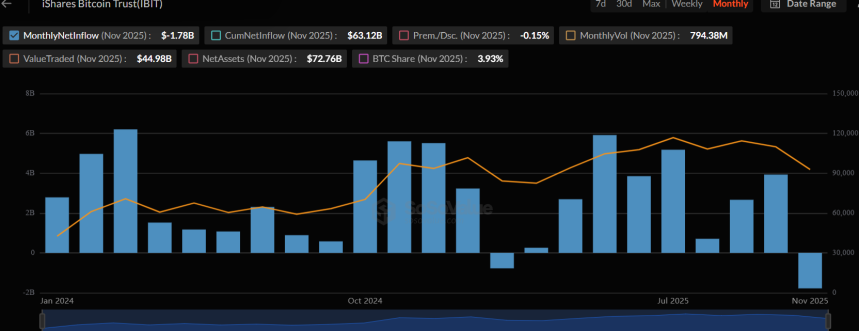

- IBIT saw a 19% decline this quarter despite managing over $73 billion in assets.

- Spot Bitcoin ETF funds recorded $2.59 billion in outflows in November.

- BlackRock's Bitcoin ETF led with $1.78 billion in outflows, followed by Fidelity Wise Origin Bitcoin Fund with $540 million.

Ethereum ETFs also faced outflows totaling $74.2 million, with BlackRock selling off $165.1 million. In contrast, Solana spot ETFs reported net inflows of $30.09 million, marking 15 consecutive days of inflows.