16 0

Blue Ocean Launches Blockchain-Based 24/7 Stock Trading Platform

On October 10, Blue Ocean, an off-exchange platform for overnight US stock trading, announced its entry into blockchain-based equity offerings. This allows investors to trade blue-chip stocks like Apple and Tesla after traditional markets close.

- Blue Ocean plans to list stocks directly on the blockchain, enabling 24/7 trading in smaller fractions.

- This move could democratize equity ownership, offering continuous market access globally.

- The initiative follows a system upgrade in August due to a system overload.

Market Trends

- Blue Ocean's venture aligns with major US trading platforms increasingly adopting cryptocurrencies.

- Intercontinental Exchange (ICE) acquired Polymarket for $2 billion, reflecting institutional interest in asset tokenization.

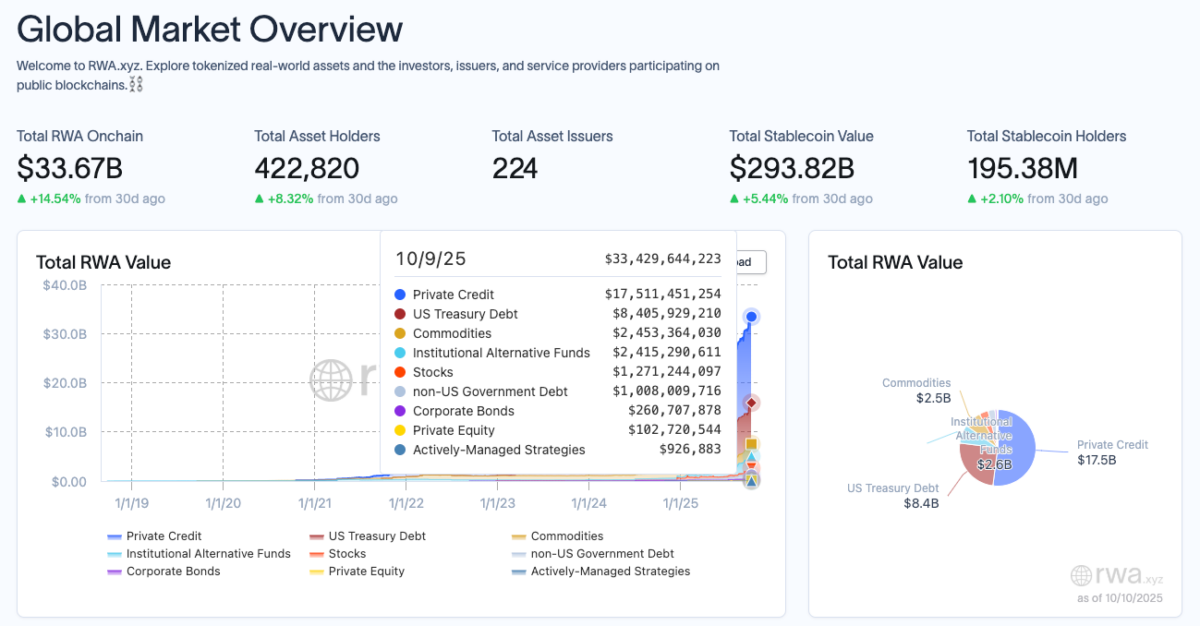

- The global asset tokenization sector has grown to $33 billion, with private credit leading at $17.5 billion.

- Nasdaq filed a proposal with the SEC to enable tokenized securities trading.

Global Real-World Asset (RWA) sector rises 14.7% in 30 days to hit $33 billion on October 10, 2025 | Source: RWA.XYZ

Community-Driven Projects

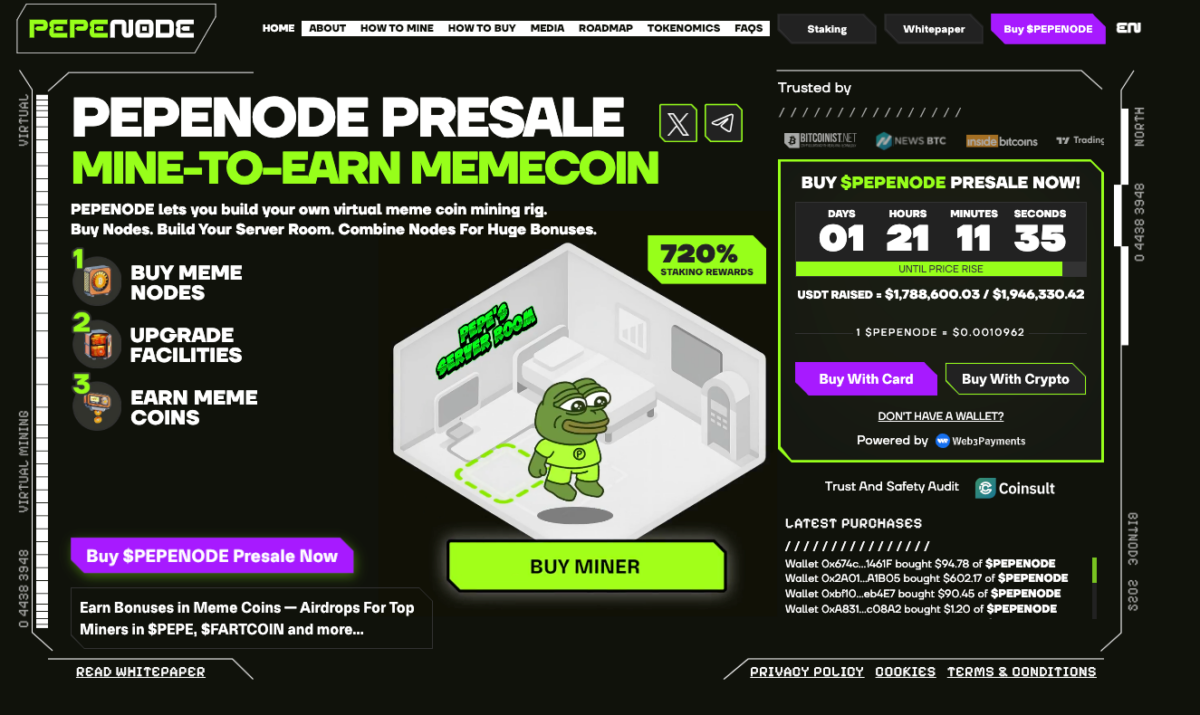

- Pepe Node, a community-driven crypto project, is gaining traction amid expanding tokenized markets.

- The Pepe Node presale has raised over $1.16 million of its $1.3 million target.

Pepe Node Presale