11 0

BNB Chain Proposes Reducing Gas Fees Amid Rising Trading Activity

- BNB Chain validators propose reducing the minimum gas price from 0.1 Gwei to 0.05 Gwei and decreasing block intervals from 750 ms to 450 ms.

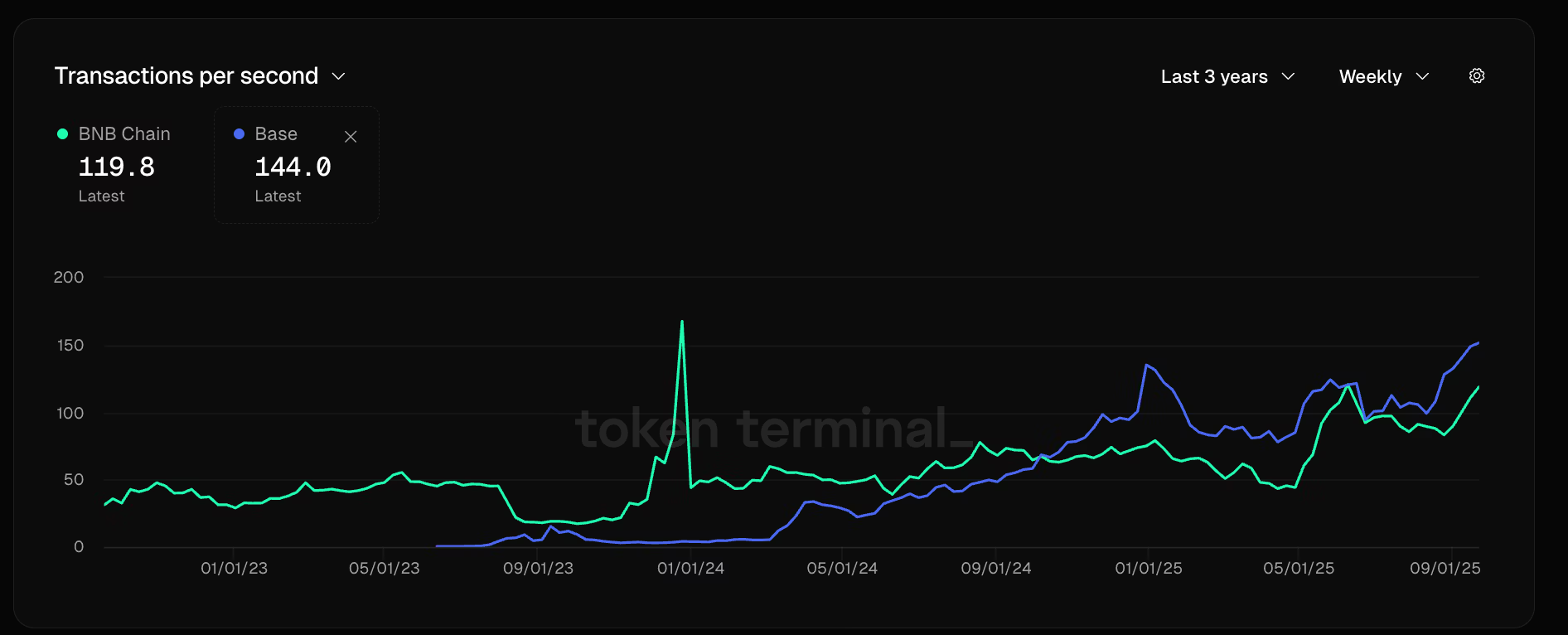

- The goal is to lower average transaction costs to approximately $0.005, enhancing competitiveness with low-cost chains like Solana and Base.

- This follows previous reductions: April 2024 saw gas cut from 3 Gwei to 1 Gwei, and May further reduced it to 0.1 Gwei, resulting in a 75% fee drop.

- The proposal emphasizes maintaining staking APY over 0.5% while aiming for minimal gas fees as key to network growth.

- On-chain trading activity is increasing, with Aster becoming a prominent trading platform. It processed $29.37 billion in perpetual futures volume in the past day.

- Aster's daily revenue hits $7.2 million, surpassing HyperLiquid's $2.79 million. ASTR token surged 37%, raising its market cap from $931 million to $3.74 billion.

- BNB Chain's trading-related transactions rose from 20% in early 2025 to 67% by June; lower costs could further boost growth.

- BNB token decreased by 1% in the last 24 hours but remains above $1,000, with a daily volume of $3.8 billion.