9 0

Bank of America Advises 4% Crypto Allocation Amid Market Volatility

Bank of America's Crypto Allocation Guidance:

- Bank of America recommends clients allocate 1% to 4% of portfolios in cryptocurrencies.

- The advice comes after Bitcoin's volatility, from a high of $126,000 in October to lows near $82,000 in November, stabilizing around $90,000 by early December.

- Investment strategists plan to cover four Bitcoin ETFs by 2026.

- The bank serves approximately 70 million clients, with significant digital and retail presence.

Crypto Market Dynamics:

- Corporate demand for crypto rose significantly at the end of November.

- CoinShares reported $1.07 billion in crypto ETP inflows, driven by expectations of a US rate cut.

- The US contributed nearly $1 billion to these inflows, with strong demand for Bitcoin (https://holder.io/coins/btc/), Ethereum (https://holder.io/coins/eth/), and XRP (https://holder.io/coins/xrp/).

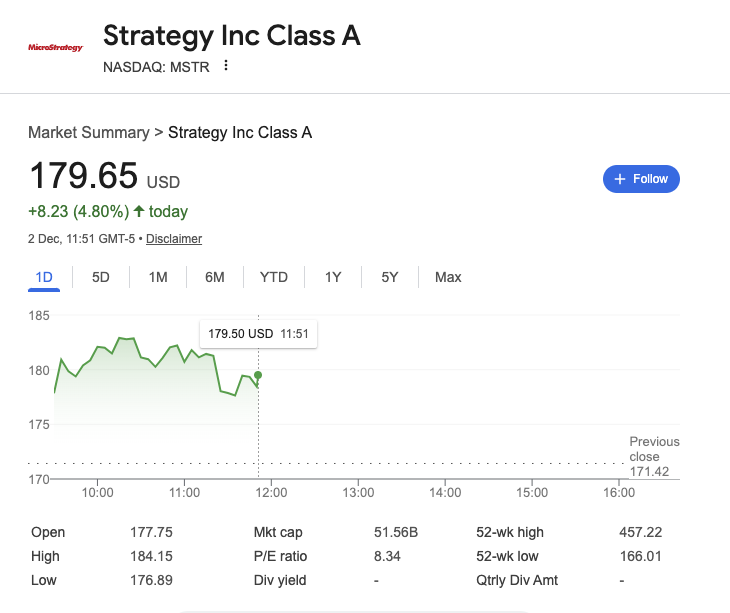

Strategy (formerly MicroStrategy) Updates:

- Strategy shares rebounded 5% on Dec. 2 after a prior decline raised liquidation concerns.

- Michael Saylor confirmed purchasing an additional 130 BTC, increasing holdings to 650,000 BTC.

- Saylor disclosed a $1.44 billion reserve for dividends and interest payments.

JPMorgan's Market Risk Insights:

- JPMorgan's Jack Caffrey notes the divergence between Bitcoin's negative performance and Gold's rally as a risk signal.

- This divergence may indicate investors preparing for a steeper yield curve, benefiting gold.

- Caffrey also noted resilience in big tech stocks and pharmaceutical firms as indicators of economic strength.