13 0

BSOL Options Trading Launches Two Weeks After ETF Debut

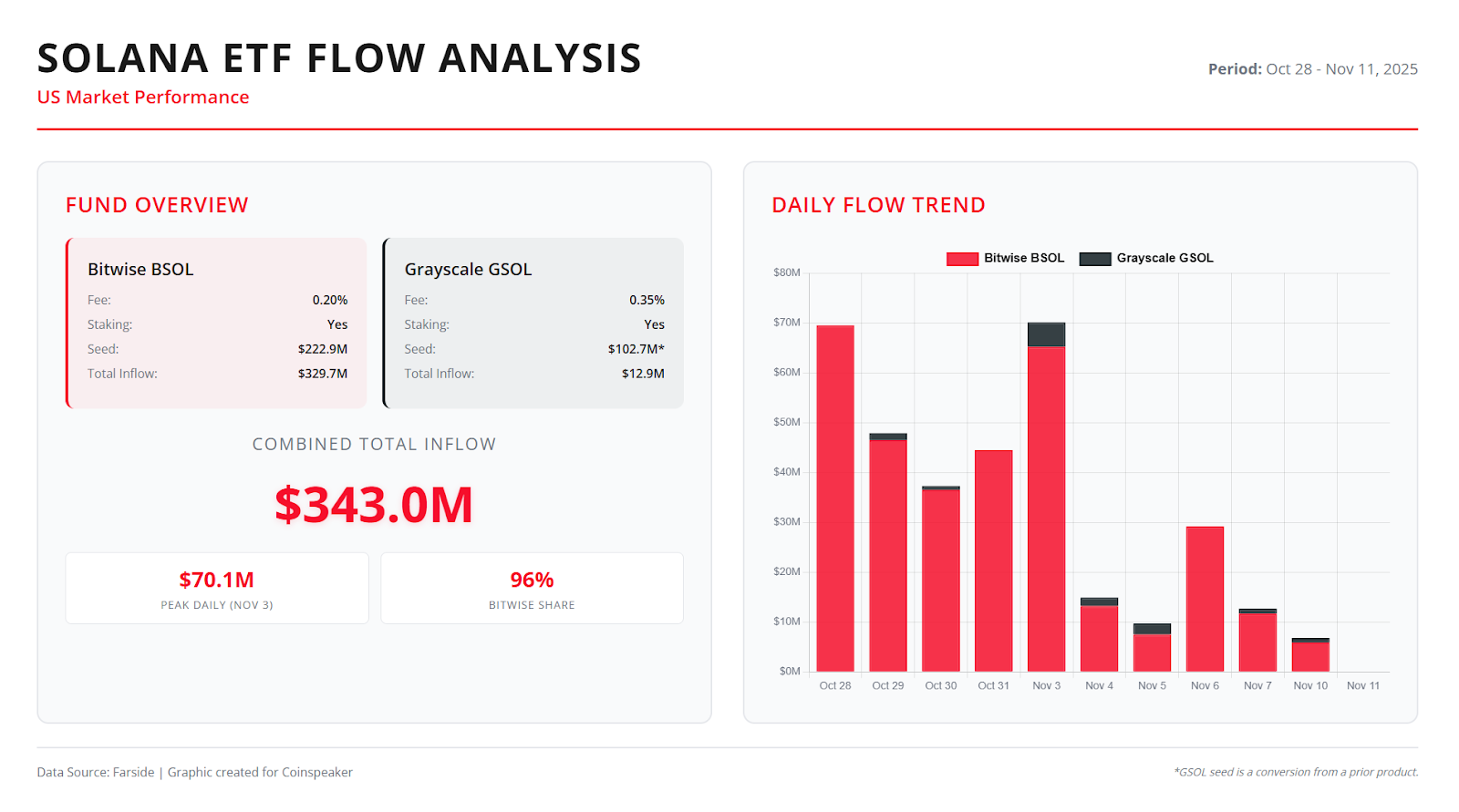

Options trading for the Bitwise Solana Staking ETF (BSOL) commenced on Nov. 11, allowing institutional investors to hedge positions and create complex strategies with Solana exposure.

- The options are available through Interactive Brokers with strike prices between $16 and $26.

- Multiple expiration dates are available, including Nov. 21, Dec. 19, Feb. 20, and May 15.

- BSOL holds $497.2 million in assets, becoming the largest Solana ETF in the US.

- The fund has captured approximately 98% of total Solana ETF inflows during its initial period.

ETF Structure and Launch

- Launched on Oct. 28 with a 0.20% management fee, waived on the first $1 billion until Jan. 28, 2026.

- Stakes 100% of its Solana holdings to generate a 7.20% net staking reward rate.

- Authorized participants can create or redeem shares in blocks of 10,000 units.

Bitwise's rapid move from ETF to options contrasts with other crypto ETFs like Ethereum, which took around 15 months post-ETF debut.

Market Activity

- Increased activity in the Solana ecosystem with DEX volumes surpassing $5 billion.

- Institutional adoption is expanding, aided by regulated product launches like BSOL options.

Bitwise manages various cryptocurrency ETPs, including Bitcoin and Ethereum products, recently approved for retail investors in the UK.