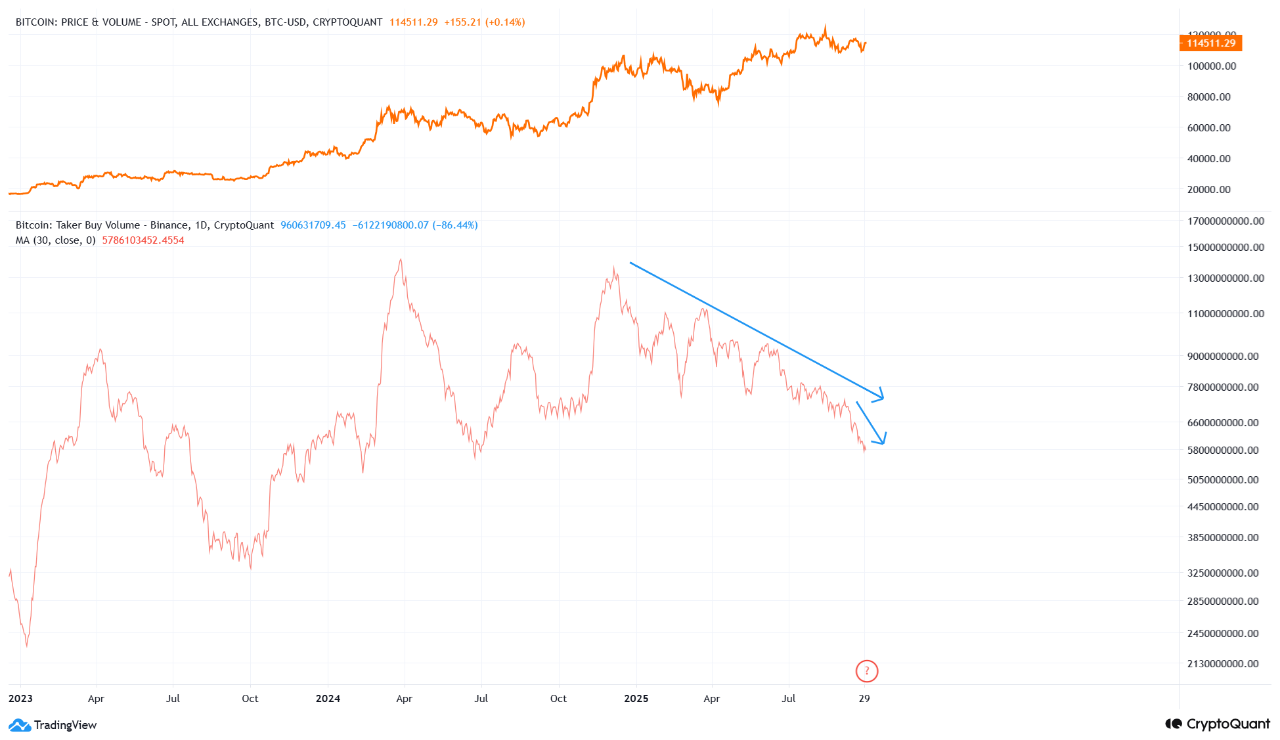

Bitcoin Buying Pressure Hits Yearly Low as Price Holds Key Levels

Bitcoin's buying pressure has dropped to its lowest in a year, as the monthly moving average of Taker Buy Volume is at levels not seen since early 2024, according to CryptoQuant. This decline began in December and suggests cautious investor sentiment.

- Data indicates potential for consolidation or price declines without a rebound in demand.

- Glassnode reports younger coin supply valuations have reset, with MVRV near 1.0.

- Bitcoin is maintaining above the 135-day SMA, indicating structural support.

Currently trading near $113,200, Bitcoin has seen a 36% increase in 24-hour trading volume but is 9% below its all-time high of $124,450 from August 14. It recently tested the $108,000–$109,000 support range twice, making the defense of $110,000 crucial to maintain a bullish outlook.

- October is historically strong for Bitcoin, with CoinGlass anticipating a potential seasonal rally.

- Karman Ashgar highlights a long-term "mega-bull run," targeting $150,000 as a minimum.

- Institutional demand remains steady, with Star Seeds raising $6.83 million to purchase Bitcoin.

Meanwhile, Bitcoin Hyper (HYPER) has raised $19.3 million in presale funding, focusing on Layer 2 solutions for faster and cheaper transactions. The HYPER token functions as a utility asset for transaction payments and staking incentives.

- Ticker: HYPER

- Presale Price: $0.013005

- Funds Raised: $19.3 million

The project offers staking rewards up to 61% APY, appealing to investors interested in Bitcoin's Layer 2 innovations.