0 0

BEARISH 📉 : Bitcoin slips below $65K amid market capitulation and pressure

Bitcoin has undergone a significant correction, dropping below $65,000, its lowest since October 2024. This decline is driven by selling pressure, reduced liquidity, and cautious institutional positioning.

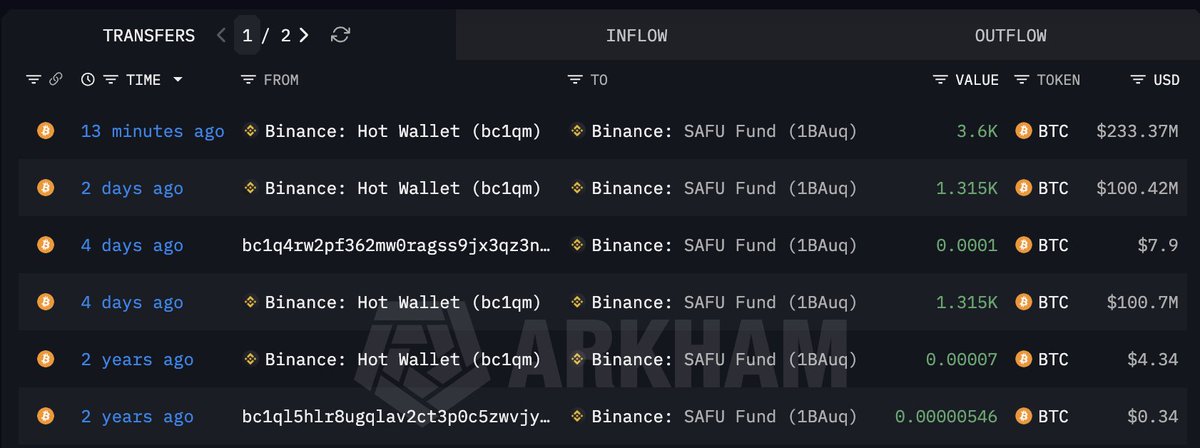

- Binance SAFU Fund purchased an additional 3,600 BTC, valued at approximately $233.37 million, indicating strategic accumulation amid volatility.

- Market sentiment mirrors levels seen during the 2022 bear market, with reduced speculative activity and increased risk aversion among investors.

Institutional Accumulation Amid Capitulation

The Binance SAFU fund's total recent Bitcoin purchases amount to around 6,230 BTC, valued near $434.5 million. Such activity reflects ongoing institutional involvement but does not guarantee immediate price recovery.

- Current conditions suggest a capitulation phase, marked by sustained price declines, elevated exchange inflows, and deteriorating sentiment.

- Capitulation can last weeks to months, with high volatility and gradual confidence rebuilding.

- Key metrics to monitor include exchange flows, derivatives leverage, spot demand recovery, and macro signals.

Weekly Structure Breakdown

Bitcoin's weekly chart shows a breakdown below the $70K support level, reflecting strong downside momentum. The price briefly touched $60K before stabilizing near $65.9K, indicating a potential deeper bear phase or late-cycle correction.

- Bitcoin is trading below the 50-week moving average and approaching the 100-week average, historically a key dynamic support.

- Volume indicates distribution rather than profit-taking; sustained high volume without further decline could signal seller exhaustion.

- If unable to reclaim $70K, risk remains toward the $60K–$55K zone; stabilization above current levels suggests absorption, crucial for recovery.