0 0

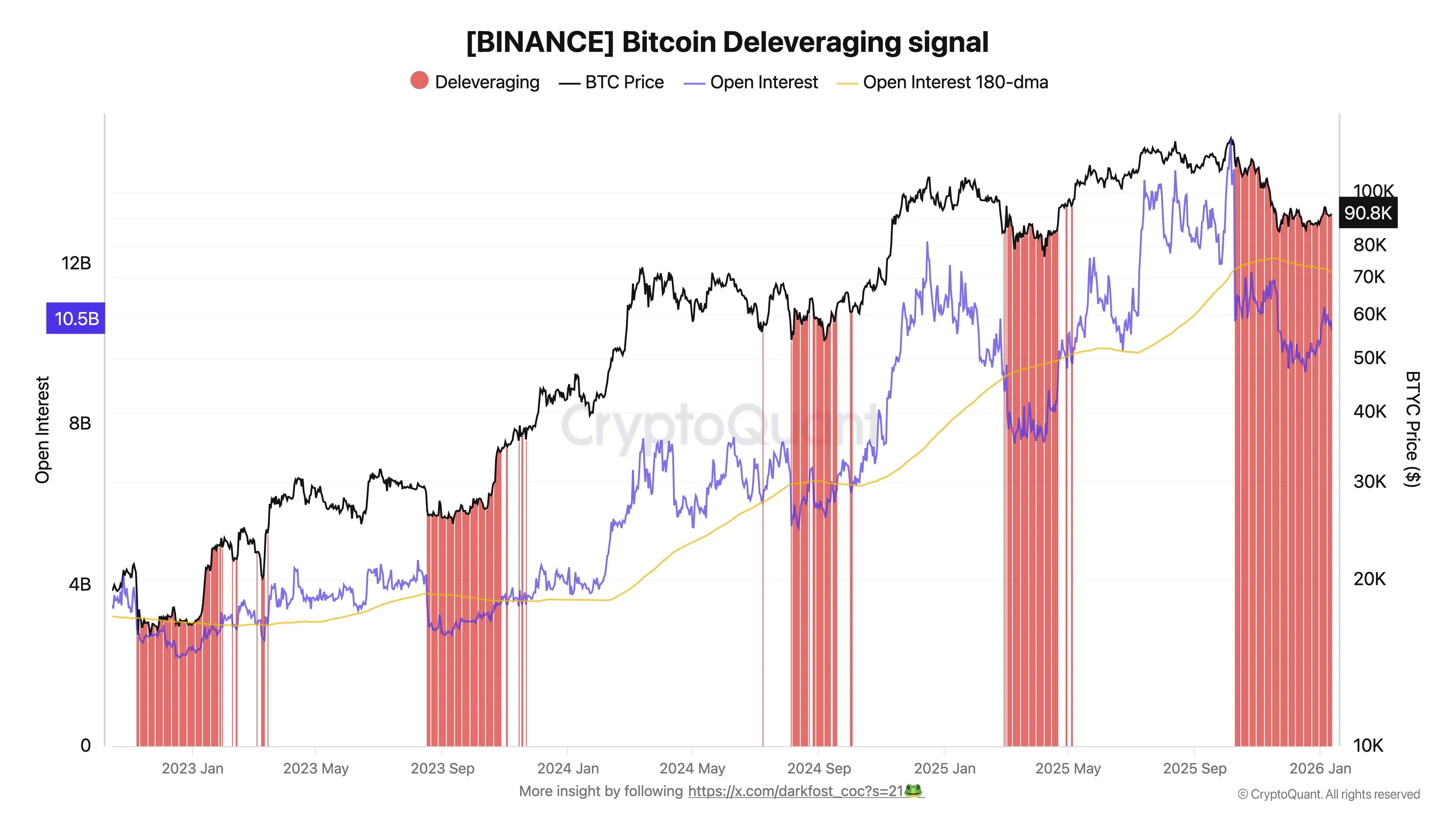

Bitcoin Futures Open Interest Drops 31%, Indicating Potential Market Bottom

Bitcoin's derivatives market is undergoing a reset following a speculative 2025. Key developments include:

- Binance open interest (OI) decreased by over 31% from its October peak.

- 2025 saw record futures trading volumes on Binance, reaching $25 trillion, pushing Bitcoin OI to an all-time high of $15 billion.

- For comparison, during the previous bull cycle in November 2021, Bitcoin's OI peaked at $5.7 billion on Binance.

- Current OI is stabilizing around $10 billion, indicating a deleveraging phase with significant liquidations.

This deleveraging helps remove excess leverage and can potentially mark significant market bottoms, setting a stage for recovery. However, the current situation does not confirm a bottom yet, as further deleveraging might occur if Bitcoin enters a bear market.

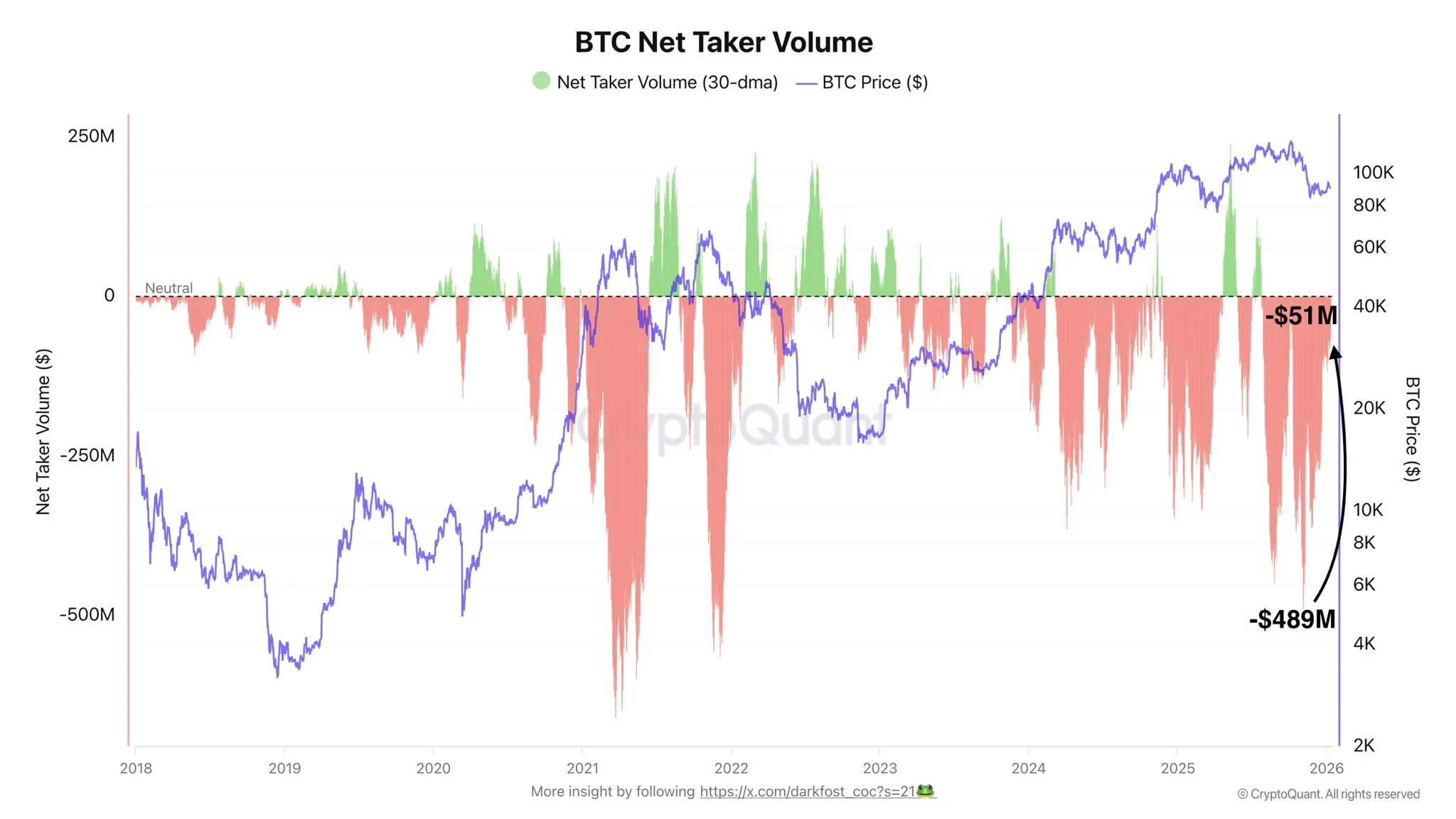

Bitcoin Sellers Losing Momentum

- A sharp decline in futures-driven selling pressure is noted, with Net Taker Volume dropping from –$489M to –$51M.

- Although sellers still dominate, the trend is moving towards positive territory.

- If Net Taker Volume turns positive, it could trigger a bullish reversal.

Currently, Bitcoin is trading at $95,131.