0 0

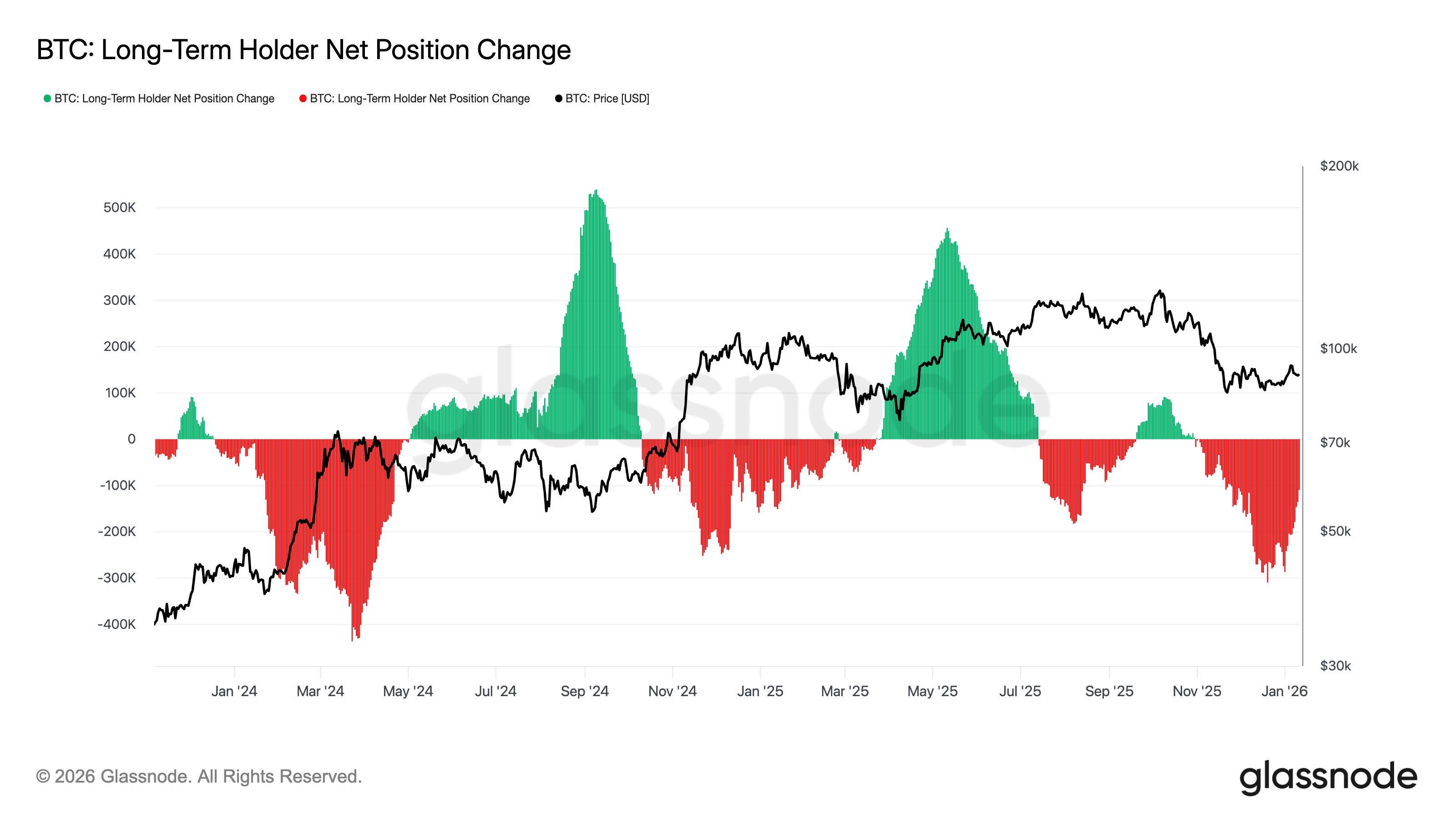

Bitcoin Long-Term Holder Outflows Decline, Easing Selling Pressure

Recent analysis indicates a decline in Bitcoin long-term holder (LTH) outflows, suggesting diminishing selling pressure. Long-term holders are those who retain their coins for over 155 days, and historically, they sell less frequently.

- The Bitcoin LTH netflow is becoming less negative, implying reduced distribution by these investors.

- Past bull rallies saw net outflows from LTHs, indicating profit-taking during price surges.

- Current distribution occurs amidst bearish market conditions, unlike previous sell-offs during price increases.

- Net outflows have decreased, suggesting the market is absorbing long-held coins.

- The Realized Profit metric has dropped, indicating fewer profits being taken by LTHs.

Glassnode notes that such trends can signal uncertainty often seen during mid-bull market pauses or early bear markets.

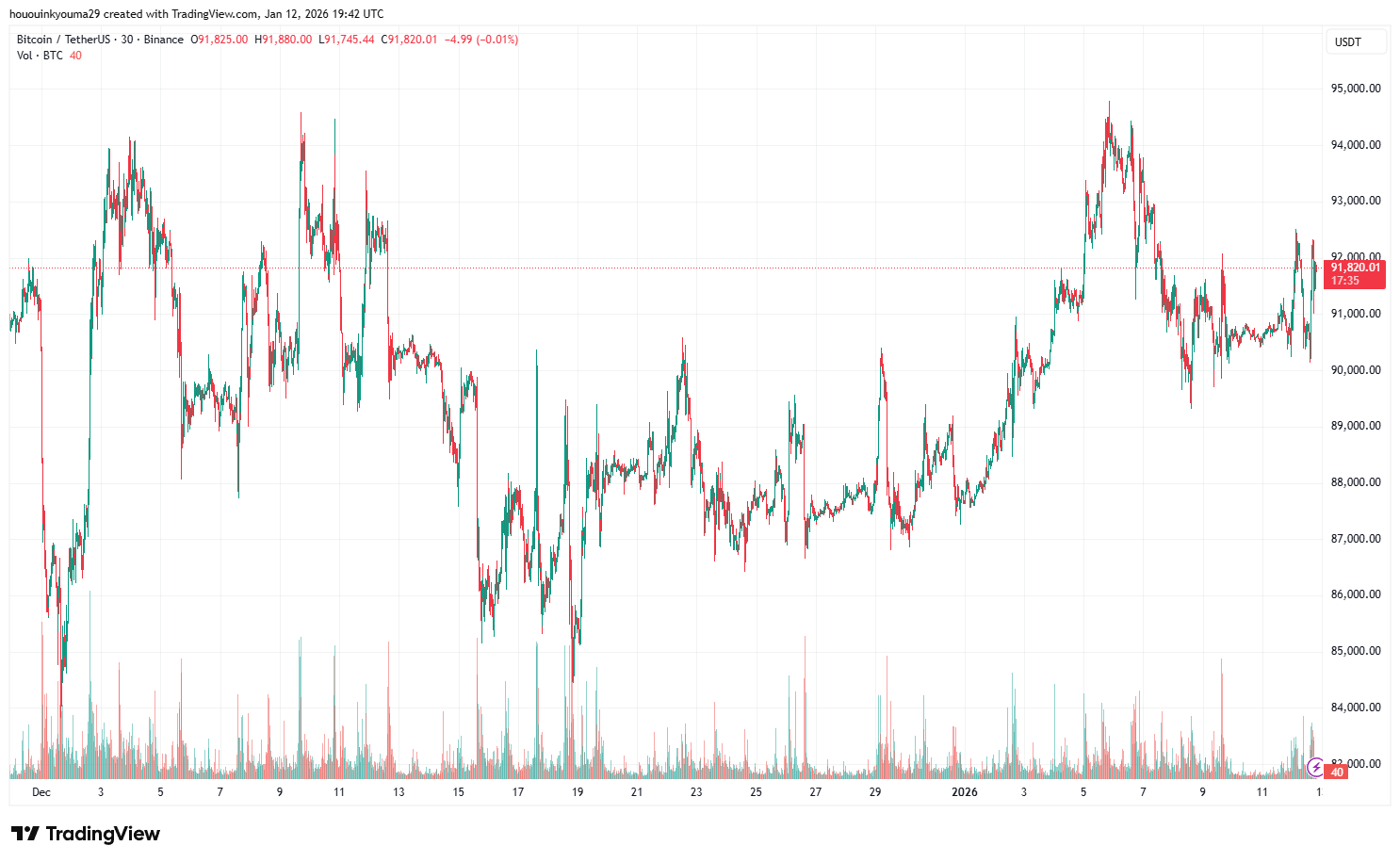

Bitcoin's current price is approximately $91,800, experiencing a near 3% decrease over the past week.