16 8

Bitcoin Long-Term Holders Stop Selling, Easing Supply Pressure

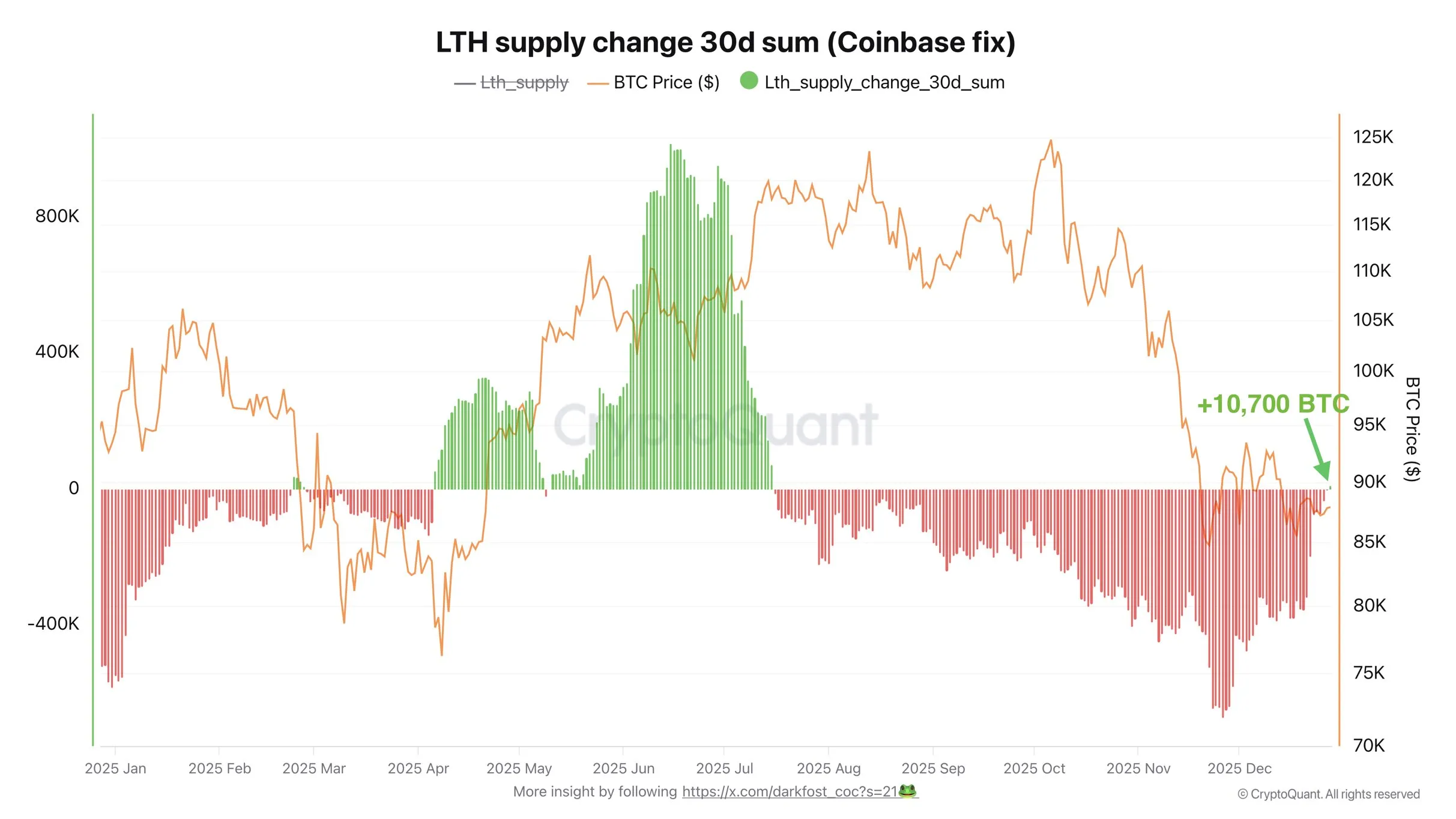

- Bitcoin's long-term holders have ceased net selling, potentially reducing structural supply pressure as we approach 2026.

- The supply held by long-term holders, previously negative, is now modestly positive, indicating a shift from distribution to accumulation.

- On-chain analyst Darkfost highlights a significant movement of nearly 800,000 BTC from Coinbase that affected data interpretation. Since July 16, the monthly long-term holder (LTH) supply change has shifted back to positive territory.

- Approximately 10,700 BTC have transitioned into long-term holdings, suggesting a halt in persistent sell pressure.

- CryptoQuant CEO Ki Young Ju confirms this trend, noting that Bitcoin long-term holders have stopped selling.

- VanEck’s Matthew Sigel describes this as easing a major Bitcoin headwind, marking it as the largest sell-pressure event since 2019.

- James Van Straten notes historical parallels, with similar distribution magnitudes marking previous market bottoms like in 2019.

- At the time of reporting, Bitcoin traded at $88,623.