7 0

Bitcoin Lags Behind Markets Despite Macro Risk Surge, Analyst Explains

Bitcoin is currently lagging behind macroeconomic trends, with the market displaying signs of being late-cycle and emotionally strained. Despite this, there is optimism that the market is approaching a euphoric stage of the bull cycle.

Key Points

- Bitcoin's current stagnation is attributed to sentiment reflexivity, with negative sentiments on Crypto-Twitter creating a feedback loop.

- The Fear & Greed Index does not show extreme greed levels, indicating a lack of classic euphoria seen before market tops.

- Macro correlations suggest Bitcoin is lagging rather than diverging, with the M2 money supply rising significantly in recent months.

- Gold's rise suggests Bitcoin could move towards $135,000 from its current level of around $115,000.

- Market microstructure indicates significant liquidity build-up, hinting at potential explosive breakouts for Bitcoin.

Altcoin Market Insights

- Altcoins are showing strong momentum, with Total2 and Total3 indices reaching new highs.

- Wyckoff accumulation patterns and ascending triangle formations suggest further growth potential for altcoins.

- Bitcoin dominance is projected to decrease, potentially leading to a significant altcoin rally.

Technical Analysis

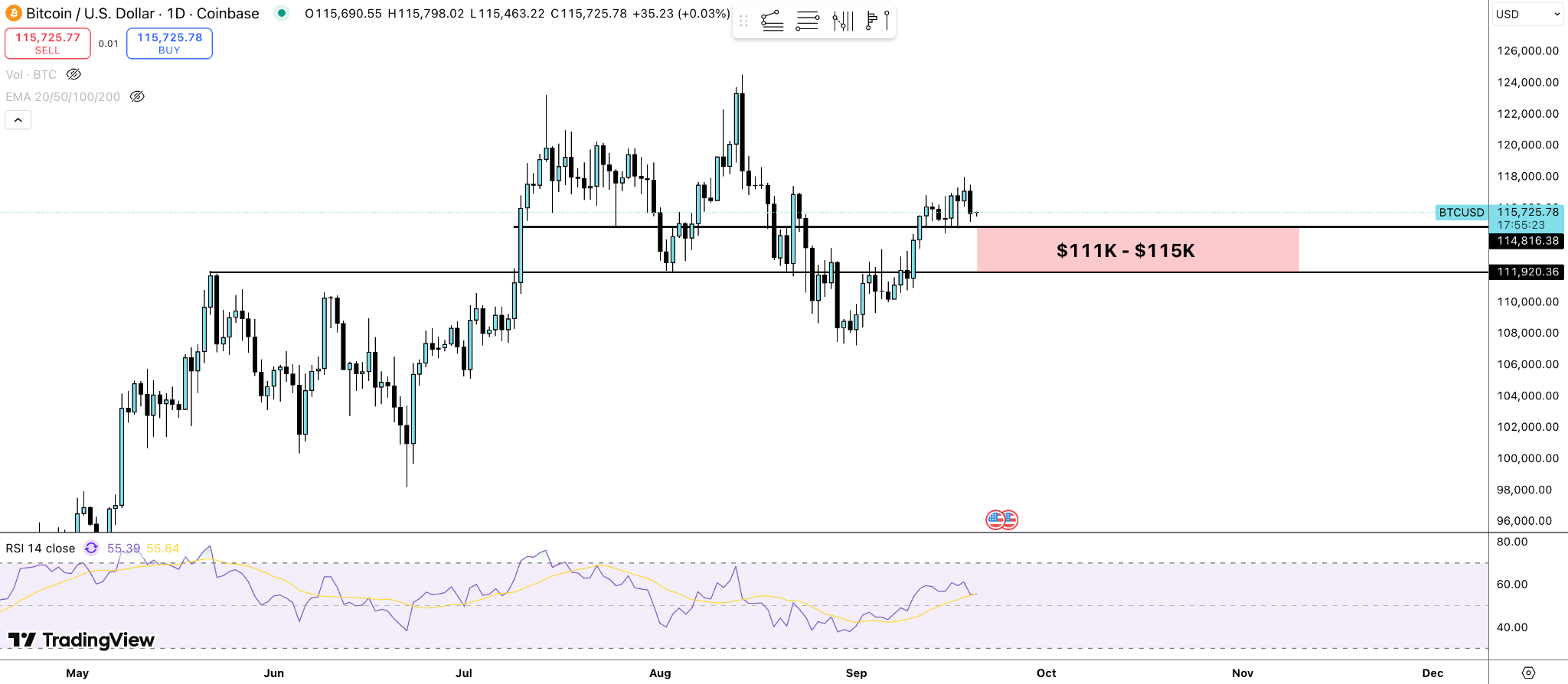

- Key price zone for Bitcoin is between $111,000 and $115,000; losing this range could push the price to $105,000.

- USDT dominance suggests room for risk-taking before stablecoin dominance rises again.

- A possible short-term scenario involves Bitcoin hitting $120,000, triggering liquidation, then dropping to the low $100,000 range.

At the time of reporting, Bitcoin is trading at $112,712.