5 0

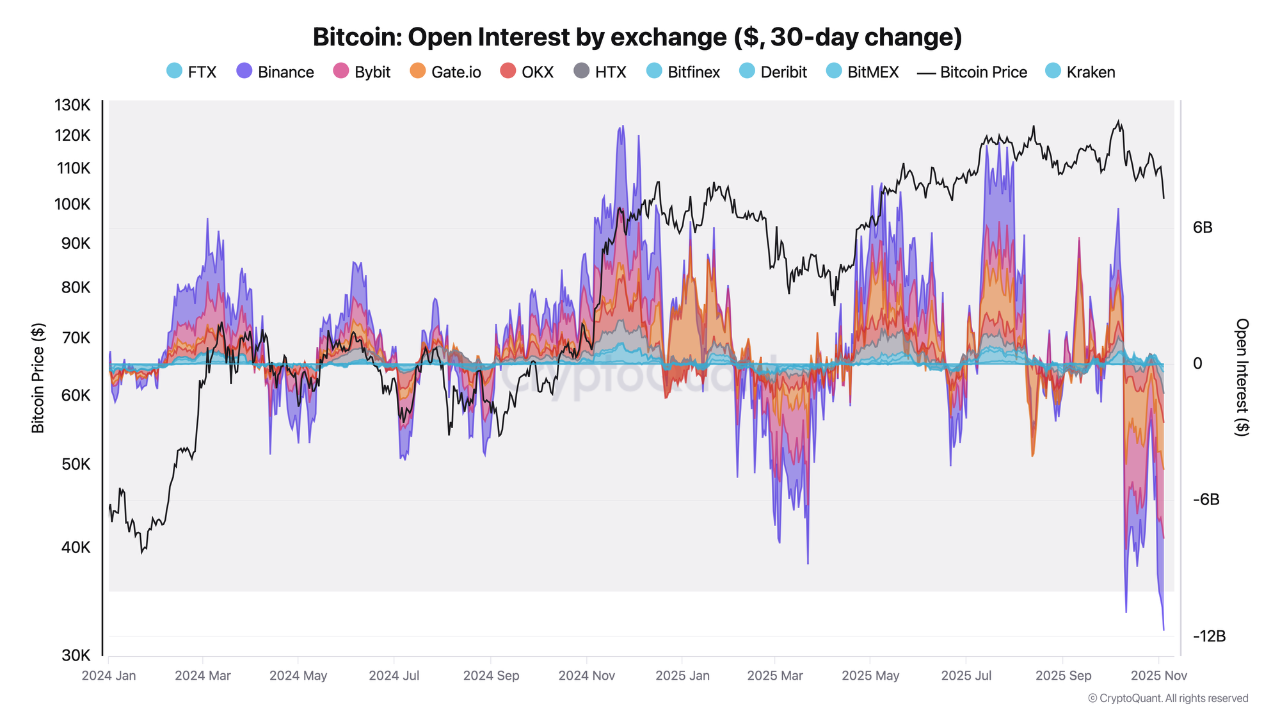

Bitcoin Open Interest Drops $10B as Traders Reduce Leverage

Bitcoin Market Update:

- Bitcoin briefly dipped below $100,000 but is attempting to stabilize around $103,000. This level is critical for market sentiment and future price direction.

- The market is experiencing high volatility and selling pressure, with momentum slowing as traders seek signs of stabilization.

Leverage and Open Interest:

- Post-October 10, Bitcoin experienced a significant decline in open interest, with over $10 billion in leveraged positions liquidated. This has led to the largest 30-day decline in open interest since the start of the cycle.

- Major exchanges like Binance, Bybit, and Gate.io have seen substantial decreases in open interest, indicating aggressive deleveraging.

- This reduction in leverage could lead to healthier market conditions by removing excessive speculation and strengthening market foundations.

Price Support Levels:

- Bitcoin trades below its 50-day and 100-day moving averages, which are now resistance levels around $110,000.

- The 200-day moving average at $102,000 serves as key support; falling below this could push prices toward $95,000.

- The current market structure suggests a shift from bullish to corrective, with lower highs forming.

Outlook: Traders focus on whether Bitcoin can hold the $100K–$103K zone. A sustained defense here might pave the way for recovery, while losing this range could trigger further liquidations. The market sentiment remains cautious.