6 0

Bitcoin Rebounds to $94,000 Amid Accumulation and Seller Exhaustion

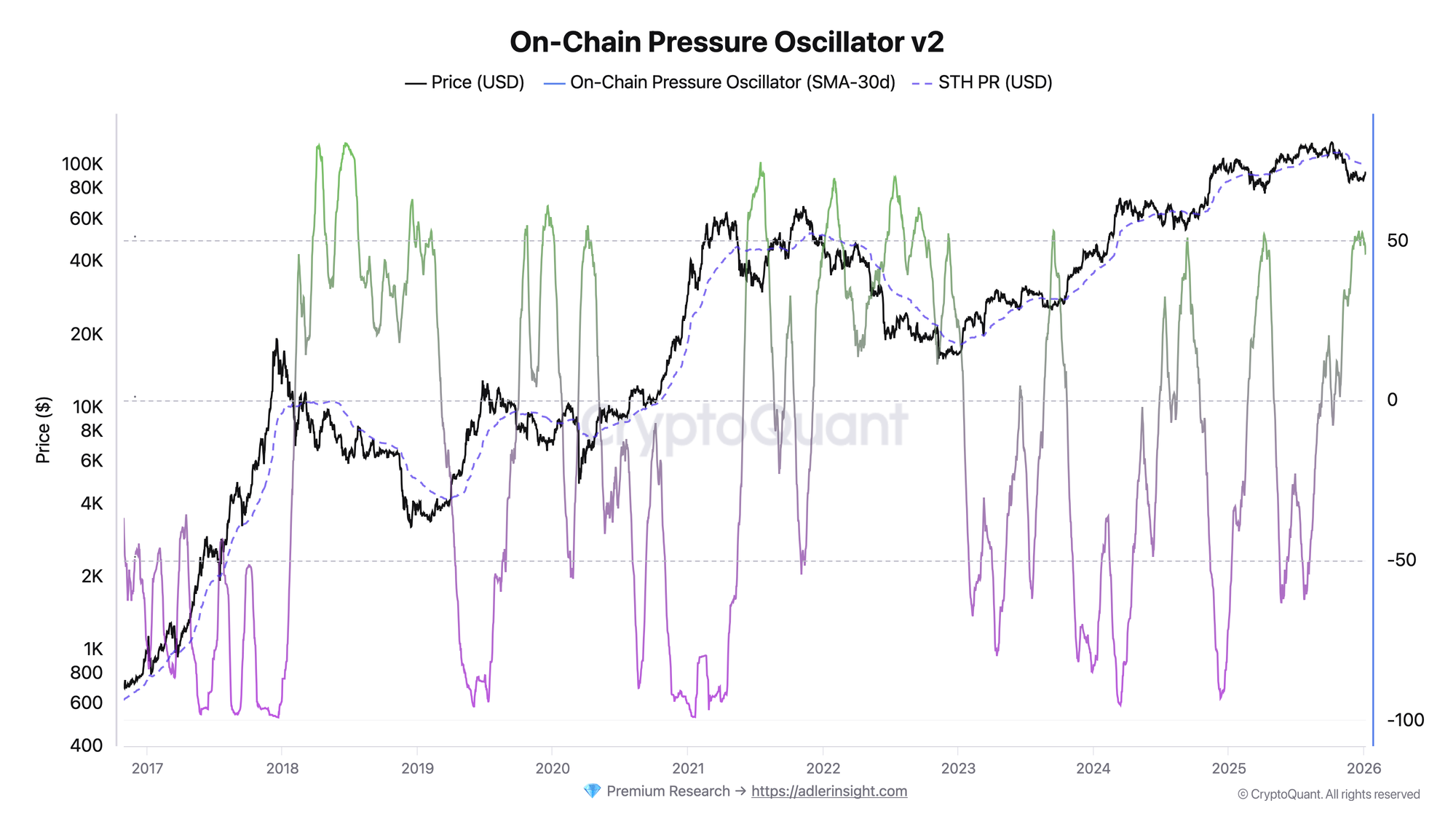

Bitcoin has reclaimed the $90,000 level, injecting cautious optimism into the market. On-chain data suggests stabilization beneath the surface despite weeks of consolidation and selling pressure.

- The On-Chain Pressure Oscillator is at 46, indicating accumulation rather than distribution.

- Exchange inflows are low, showing a lack of aggressive sellers.

- Long-term holders remain steady, while short-term holders' losses are contained.

Short-Term Holder Stress

- The market is in a consolidation phase, with stable oscillator trends.

- Selling pressure is limited due to underwater short-term holders.

- A breach below neutral levels in the oscillator could shift dynamics toward distribution.

If Bitcoin reaches $100,000, it may face increased resistance as short-term holders reach breakeven. A stronger signal would be reclaiming the short-term holder realized price alongside a strengthening oscillator.

Resistance Challenges

- Bitcoin trades near $94,000 after rebounding from lows around $82,000–$84,000.

- The short-term moving average offers dynamic support, indicating eased downside momentum.

- Mid- and long-term moving averages, between $100,000 and $105,000, present significant resistance.

The market appears to transition from a sell-off to consolidation and recovery. Maintaining above $90,000–$92,000 is crucial for the constructive setup. A move above declining moving averages would indicate a durable market shift.