8 1

Bitcoin Supply Overhang: 6.6 Million BTC Bought Above Current Price

On-chain analysis indicates that a significant portion of Bitcoin's supply is purchased at prices higher than the current market rate, suggesting potential for volatility if the price rebounds.

Key Points

- Over 6.6 million BTC have a cost basis above the current spot price, making them "Supply In Loss."

- The "Supply In Loss" measures Bitcoins with unrealized losses by comparing their last transaction price to the current price.

- Currently, around one-third of the BTC supply is below its purchase price, indicating high levels of market distress not seen since earlier in 2023.

- The "UTXO Realized Price Distribution (URPD)" chart shows where these loss-making coins are distributed across different price levels.

- Investors may sell as prices rise to their purchase levels, contributing to selling pressure and potential volatility.

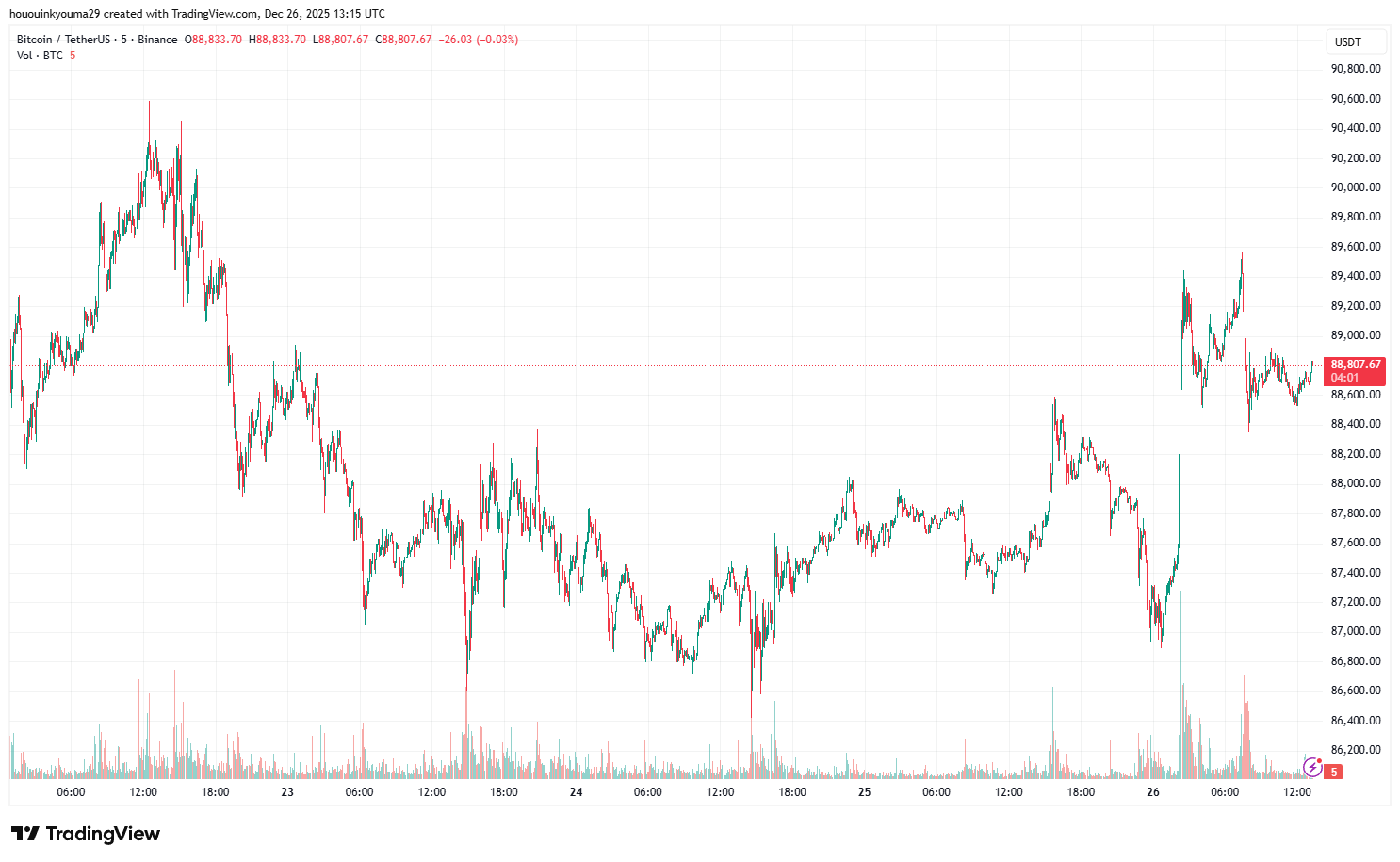

BTC Price Update

- Bitcoin recently rebounded to $88,600.

With a large portion of the supply underwater, any upward movement might trigger selling, affecting price stability.