2 0

Bitcoin Trades at $114,042 Testing Resistance Amid Market Caution

Bitcoin has decreased over 8% from its peak of $124,500, creating bearish sentiment in the market. This drop, though moderate compared to past declines, has led to a cautious atmosphere among traders and investors.

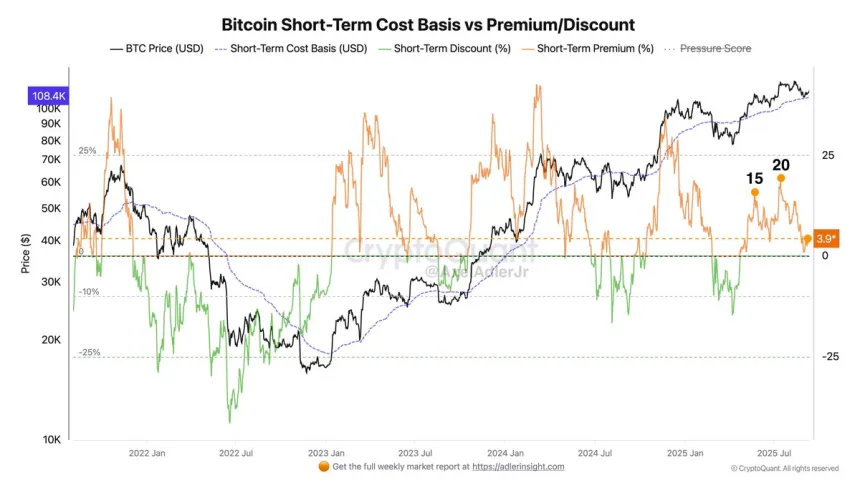

- Bitcoin is trading with only a 4% markup above the average purchase price of Short-Term Holders (STHs), indicating fragile confidence among recent buyers.

- The Federal Reserve's rate cut supports risk assets like Bitcoin, though it may result in volatility as profits are locked in.

- Bitcoin currently trades at a 15–20% markup relative to STHs' average purchase price, which could lead to increased selling pressure.

Historically, significant pullbacks have attracted sidelined buyers. However, in a mature bull cycle, investors wait for corrections before buying, highlighting the need for meaningful discounts to attract new capital.

Price Action Details: Key Levels To Watch

Bitcoin is trading at $114,042 after rebounding from lows near $110,000. It faces resistance around the 100 SMA at $114,679. A break above this could lead to a move toward $116,000, with major resistance at $123,217.

- The 50 SMA at $112,025 and the 200 SMA at $112,167 provide short-term support, establishing a solid base around $112,000.

- Failure to break the 100 SMA convincingly could lead to sideways consolidation or a retest of $112,000, with potential further decline to $110,000.