4 2

Bitcoin Volatility Drops Below 99 Nasdaq 100 Companies, Boosts $HYPER

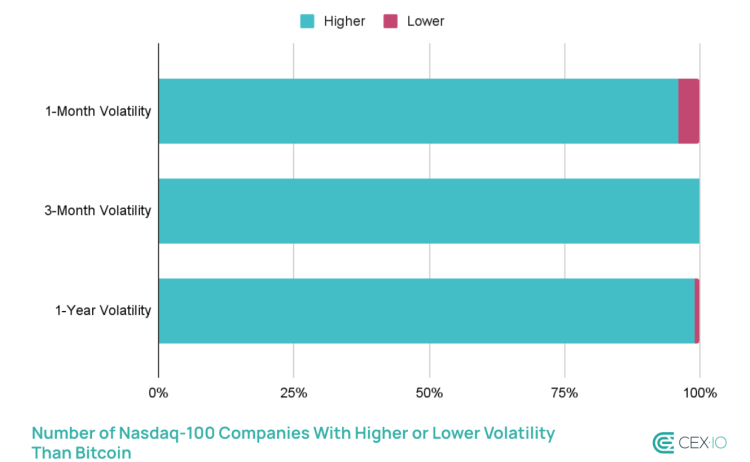

Bitcoin's volatility has decreased significantly, now lower than 99 of the top 100 companies in the Nasdaq 100 index. This marks a shift from its earlier reputation for wild price swings.

- Data from CEX.io indicates Bitcoin's realized volatility is currently more stable than major tech companies like Apple and Microsoft.

- Increased market cap and liquidity have contributed to this stability, preventing dramatic price changes from single transactions.

- Despite reduced volatility, Bitcoin continues to outperform most major tech stocks in returns, only outpaced by Alphabet among the 'Magnificent Seven'.

Bitcoin Hyper ($HYPER) Development

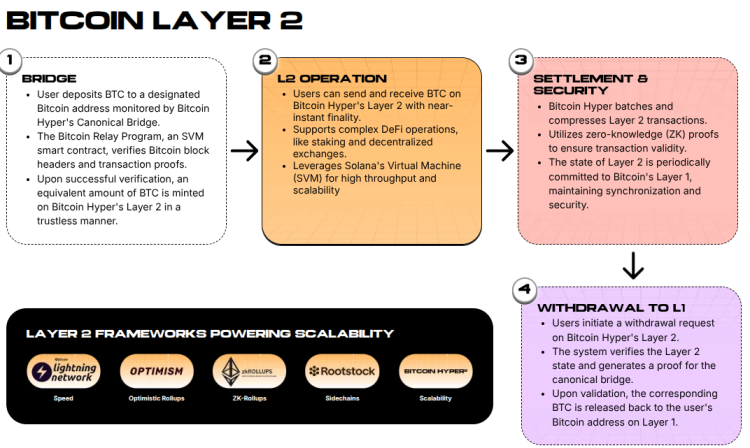

- Bitcoin Hyper is a Layer-2 solution designed to enhance Bitcoin's transaction speed and reduce fees.

- Utilizes the Solana Virtual Machine (SVM) for fast, cost-effective transactions without replacing Bitcoin's core functions.

- $HYPER, the network's native token, supports gas fees and governance, with a significant presale success raising over $16.8M.

This development aims to combine Bitcoin's security with Solana's speed, potentially transforming it into a more versatile asset for DeFi applications.