10 1

Bitcoin Volatility Surges on 91% Chance of Fed Rate Cut

Market Overview

- Bitcoin's price shows high volatility, dropping from $123,000 to $120,000 but recovering to $121,400. Volatility is increasing due to an expected Federal Reserve rate cut.

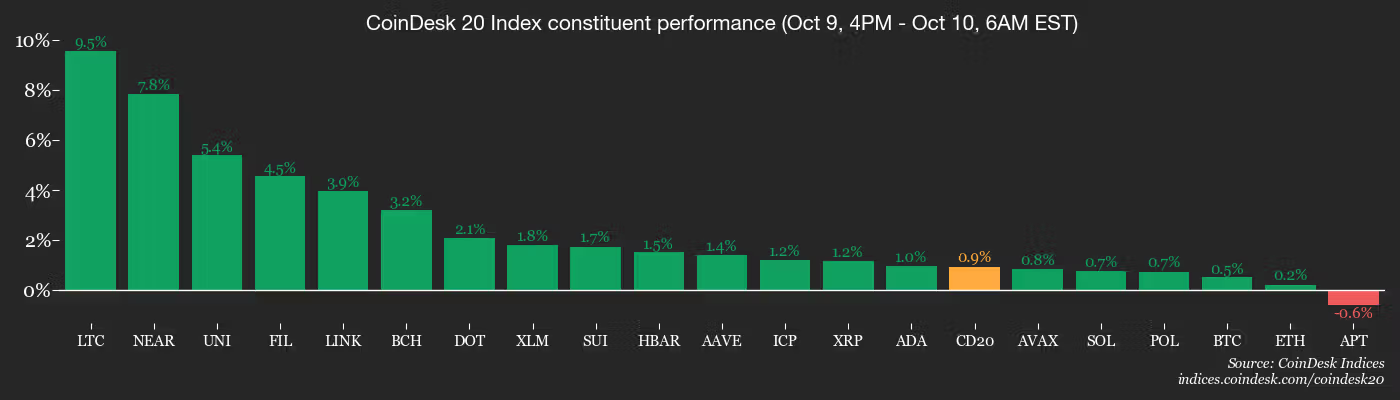

- The CoinDesk 20 Index increased to 4,178 points from a low of 4,097.

- Privacy coins like Zcash and Dash are seeing sharp increases.

- Polymarket indicates a 91% chance of a Fed rate cut by 25 basis points at the end of October.

- State Street's report reveals 60% of institutional investors plan to increase digital asset exposure next year.

- U.S. Democratic senators propose a "restricted list" for risky DeFi protocols, which could affect regulatory progress.

- Chainlink launches a new RPC endpoint for the HyperEVM testnet, enhancing infrastructure for developers.

Derivatives & Market Positions

- BTC perpetual short positions face liquidation risk above $121,600, suggesting potential for a short squeeze.

- Overall positioning in BTC futures remains high with open interest near record levels.

- BNB, XRP, ADA, and TRX show a decrease in futures open interest, indicating capital outflows.

- XMR market shows high demand with annualized funding rates nearing 60%.

- Open interest on Derive favors bullish options for BTC and ETH, with calls concentrated at higher strike prices.

Crypto Equities and ETFs

- Coinbase (COIN) closed at $387, slight decline observed.

- Galaxy Digital (GLXY) shows positive movement, closing at $43.10.

- Spot BTC ETFs see daily net flows of $197.8 million, with cumulative flows at $62.73 billion.

- Spot ETH ETFs have a net flow of -$8.7 million.

Technical Insights

- BTC's dominance rate has risen from 57% to over 59%, indicating stronger market leadership.

- No significant altcoin season as capital flows back into BTC.

Additional Highlights

- Bitcoin's implied volatility index rises above 42, reflecting seasonal strength.

- Monero releases an upgrade to enhance privacy against network node threats.

- Hyperliquid introduces a DEX-powered live streaming platform called 'Based Streams.'

- Ray Dalio warns of U.S. economic challenges, including soaring debt and potential civil unrest.