1 0

BULLISH 📈 : Circle and Polymarket integrate native USDC, boost market reliability

Circle and Polymarket Partnership

- Circle and Polymarket have partnered to introduce native USDC to the prediction market, replacing the bridged stablecoin version.

- Currently, Polymarket uses Bridged USDC (USDC.e) via Polygon. Native USDC allows for direct redemption with Circle's regulated entities, eliminating intermediary protocols.

- This change aims to reduce bridging risks, known as vulnerabilities in blockchain systems.

Polymarket's Trading Volume and Market Position

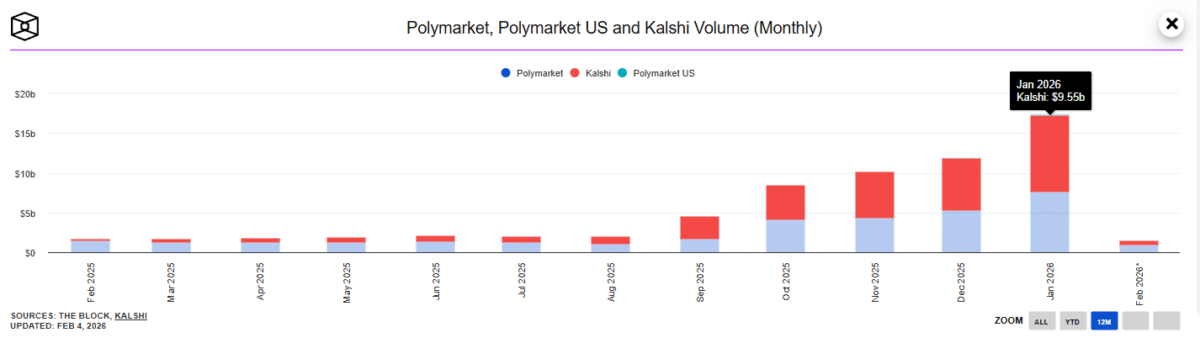

- In October 2025, Polymarket recorded $3 billion in trading volume on Polygon with over 338,000 traders.

- The platform saw a 57% increase in notional trading volume, reaching $22 billion in the first eleven months of 2025.

- As of January 2026, monthly volume was $7.66 billion, making Polymarket the second-largest prediction market globally.

- Kalshi remains the largest prediction market with $9.55 billion in volume, attributed to its partnership with Coinbase.

Market Implications and Regulatory Considerations

- The integration of native USDC is part of broader efforts by platforms to enhance liquidity and minimize settlement issues.

- This shift aligns Polymarket with financial institution standards, amidst increasing regulatory scrutiny on crypto prediction markets.

- Instances like Portugal ordering a halt to political betting highlight the regulatory challenges faced by such platforms.