1 0

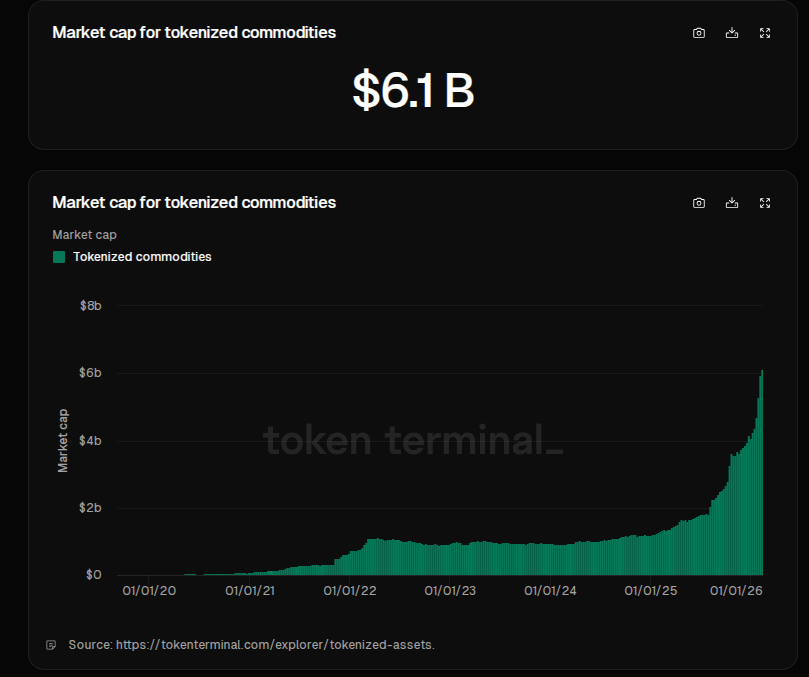

BULLISH 📈 : Gold Tokens Fuel 53% Growth in Tokenized Commodities Market

The tokenized commodities sector has surged by 53% in under six weeks, reaching over $6 billion, largely driven by gold tokens like Tether’s XAU₮ and Paxos’s PAXG. These tokens offer a convenient way to own gold without physical handling, appealing to those seeking a mobile safe haven or fractional trading.

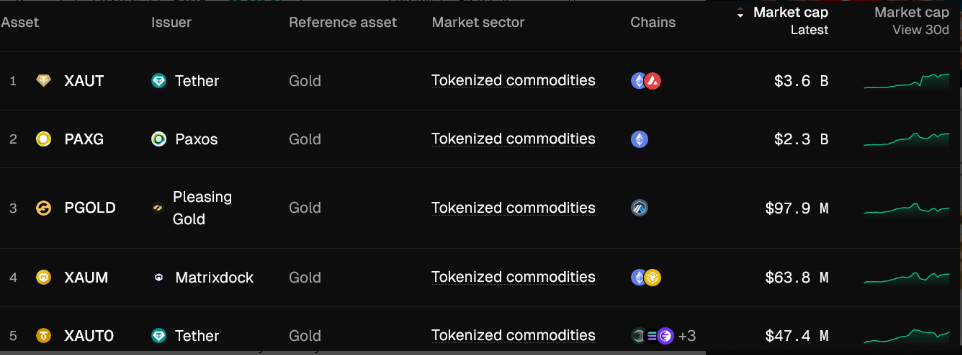

Gold Tokens Leading the Surge

- Tether's XAU₮ and Paxos's PAXG dominate, holding nearly $6 billion in market value.

- Tokens provide an easy claim on bullion, bypassing traditional vault logistics.

Tether's Physical Integration Strategy

- Tether invested $150 million in Gold.com to integrate XAU₮ with physical gold purchases using stablecoins.

- This could revolutionize access to bullion, allowing retail buyers to use crypto tools for tangible metal.

Growth Projections and Challenges

- Geoffrey Kendrick forecasts tokenized assets growing from $35 billion today to $2 trillion by 2028.

- Alvin Foo suggests gold tokens could reach trillion-dollar valuations as fractional ownership evolves.

- Success depends on regulatory clarity, custody proof, and adoption beyond crypto investors.

Stablecoin liquidity and DeFi infrastructure are vital for supporting expanded markets. With quick settlements, low barriers, and secure custody, smaller investors can access gold investments that were previously inaccessible. Establishing trust through audits and transparent rules is crucial for token holder confidence.