5 0

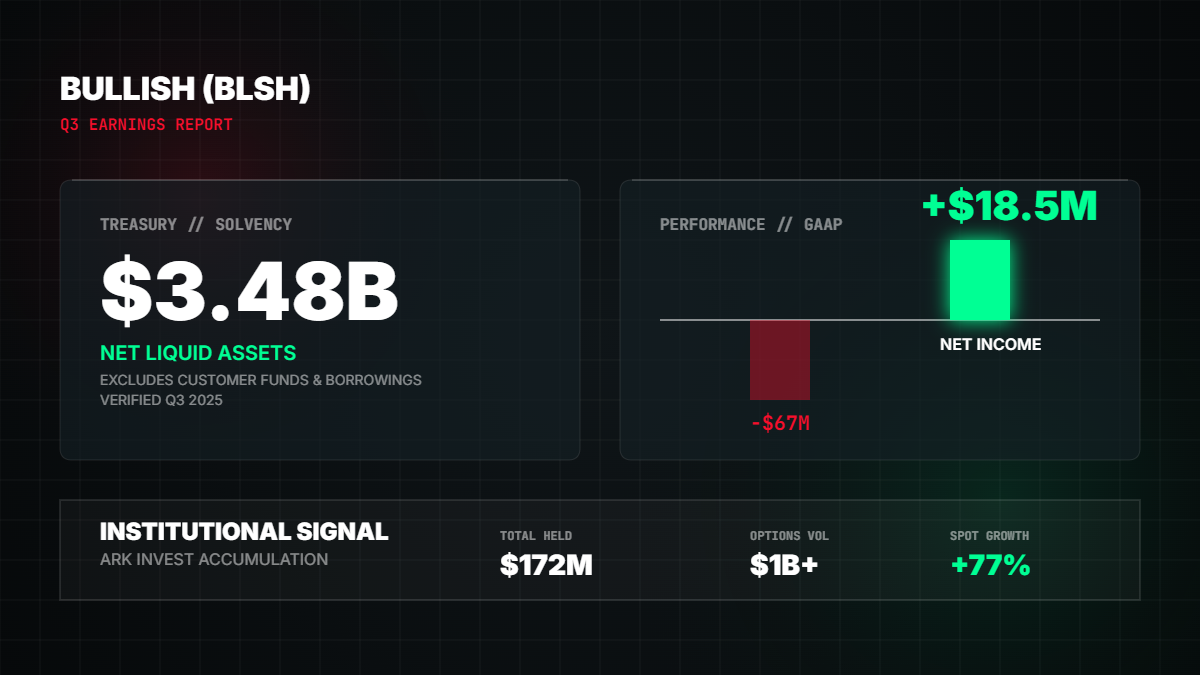

Bullish Reports $18.5M Q3 Profit, Options Volume Exceeds $1 Billion

Bullish Q3 2025 Financial Performance

- Net income reached $18.5 million, a shift from losses in the previous year.

- Adjusted revenue totaled $76.5 million, up from $44.6 million in Q3 2024.

- Adjusted EBITDA increased to $28.6 million from $7.7 million in the prior-year period.

New Business Lines and Trading Volumes

- Launched crypto options with 14 partners, achieving over $1 billion in volume in Q3.

- Started US spot trading after regulatory approval, boosting Q4 spot trading volumes by 77% compared to Q3 average.

Investor Activity

- Ark Invest acquired nearly $10 million in Bullish shares before the earnings release.

- Total investment by Ark Invest in Bullish shares amounts to approximately $172 million since its public listing.

Diversified Revenue Streams

- Significant growth in Subscription, Services, and Other (SS&O) segment revenue due to new liquidity services partnerships.

- Projected SS&O revenue for Q4 is between $47 million and $53 million.

- Expected adjusted operating expenses for Q4 are $48 million to $50 million.

- Ended the quarter with $3.48 billion in net liquid assets, excluding customer funds and borrowings.