Calamos to Launch Bitcoin ETF Offering Full Downside Protection on January 22

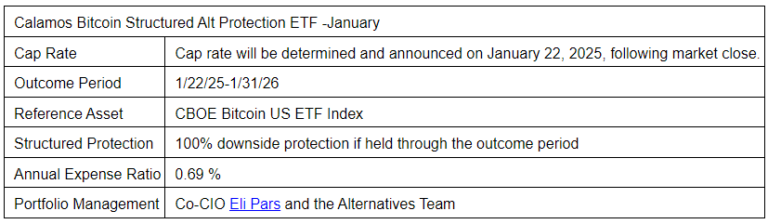

Calamos Investments will launch a Bitcoin ETF, named CBOJ, on January 22, 2025. This fund, trading on the Chicago Board Options Exchange, guarantees 100% downside protection, aiming to attract cautious investors by reducing Bitcoin's volatility.

The CBOJ ETF combines US Treasury bonds and options linked to the Cboe Bitcoin US ETF Index, ensuring no losses even during Bitcoin price declines while providing growth potential.

“Many investors have been hesitant to invest in bitcoin due to its epic volatility. Calamos seeks to meet advisor, institutional and investor demands for solutions that capture bitcoin's growth potential while mitigating the historically high volatility and drawdowns of the asset,” said Matt Kaufman, Head of ETFs at Calamos.

CBOJ ETF’s Annual Reset Mechanism — Full Protection Against Losses

The ETF features an annual reset mechanism, allowing investors to set a new cap on potential gains each year while maintaining full loss protection. This design builds on Calamos’ Structured Protection ETF series launched in 2024, which focused on stock indices like the S&P 500 and Nasdaq-100.

Source: Calamos Investments

Defined outcome products, such as buffer funds, gained popularity after the 2022 market downturn. The CBOJ applies this strategy to Bitcoin, merging traditional risk management with cryptocurrency growth opportunities.

Spot Bitcoin ETFs, introduced in January 2024, significantly impacted the crypto market, pushing Bitcoin prices above $108,000. The iShares Bitcoin Trust ETF (IBIT) became a leader, amassing over $50 billion in assets.

Structured Funds Bridges the Bitcoin Gap

Despite recent successes, financial advisors remain cautious about Bitcoin due to its volatility. Kaufman believes structured funds like CBOJ can bridge this gap, enabling investors to combine direct Bitcoin ETFs with risk-managed strategies.

Other firms, including Innovator and First Trust, are also developing similar funds. Companies like Grayscale and Roundhill have filed for Bitcoin-based income-generating funds, such as covered call ETFs, expanding the market further.

The CBOJ fund is designed for a one-year holding period, from January 22, 2025, to January 31, 2026. Its appeal lies in protecting against losses while offering exposure to Bitcoin's potential gains.