Cardano Expected to Experience Significant Price Movement Around November 18

The crypto market is experiencing heightened activity, with Bitcoin nearing all-time highs and a potential breakout for various assets. Cardano (ADA) is at a crucial point, resembling its price trajectory in 2020, when it increased by over 4,000% within a year.

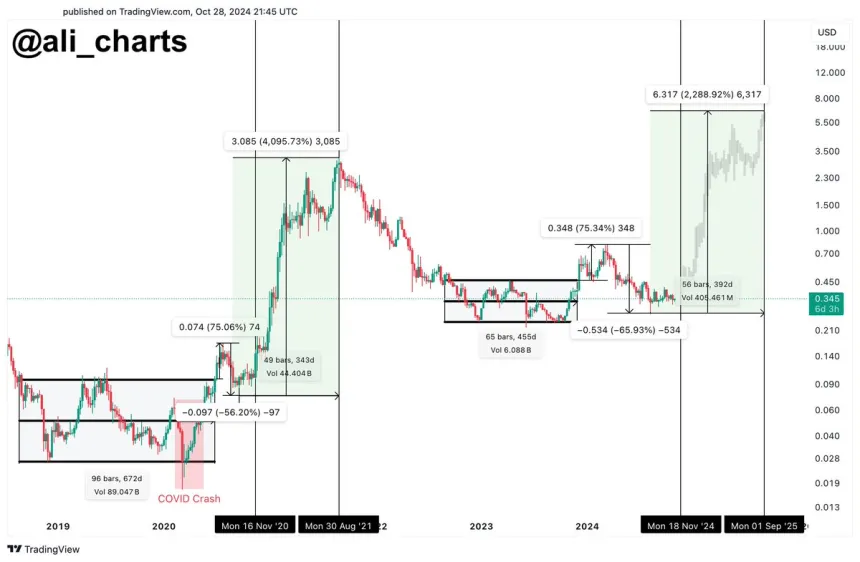

Analyst Ali Martinez provided a technical analysis indicating that ADA's recent consolidation around key levels may precede a significant upward movement, particularly after the upcoming U.S. election. His analysis emphasizes Cardano’s historical pattern of growth following accumulation phases, suggesting a strong rally if Bitcoin reaches new highs. Investors are monitoring ADA closely to determine if it can replicate its previous bull run, which could influence altcoin momentum in this cycle.

Cardano Following 2020 Bullish Pattern

Cardano's current consolidation has garnered attention from analysts and investors who view it as a potential accumulation signal, indicating a forthcoming price surge. Ali Martinez recently shared a technical analysis on X, comparing ADA’s current behavior to its performance in 2020, a year marked by an extraordinary 4,000% rise.

Martinez suggests ADA’s price action mirrors a similar setup, forecasting a breakout around November 18, approximately two weeks post-U.S. elections. This timing aligns with historical patterns showing ADA consolidating before substantial upward moves.

He projects a long-term bullish target of $6.30, implying a potential increase of 2,000% from current levels, with expectations for this rally to culminate in a market top around September 2025. This outlook is based on ADA's cyclical price trends, where significant rallies have historically followed periods of low volatility and accumulation driven by market sentiment and broader cryptocurrency adoption.

Investors are closely watching ADA, as such a rally would signify not only a pivotal moment for Cardano but could also indicate broader bullish momentum across altcoins. The current price level has attracted institutional and retail investors looking for opportunities ahead of a possible significant move.

On-chain data and technical indicators support a bullish outlook, suggesting that ADA’s forthcoming price movements may set the tone for the altcoin market in the coming months. If historical trends hold, Cardano could be positioned for a powerful surge, drawing new interest and capital into its ecosystem.

ADA Technical Levels

Currently, Cardano is trading at $0.346 after facing rejection from the 4-hour 200 exponential moving average (EMA) at $0.351. This level is critical; breaking above it and maintaining support could indicate a shift toward a short-term uptrend.

For bulls to regain control, establishing a solid position above the 200 EMA is crucial, as this would likely attract buying interest and enhance upward momentum.

Moreover, the $0.37 supply zone poses another significant challenge for ADA, as bulls have struggled to reclaim this level since early October. Persistent resistance at this zone indicates that considerable buying pressure is necessary to break through and sustain gains beyond this mark. A bullish trend could develop if ADA surpasses both the 200 EMA and the $0.37 supply zone.

If these levels remain unbroken, ADA’s price is likely to continue sideways consolidation in the near term. Such behavior might stabilize the market and attract fresh demand before attempting another breakout, potentially delaying any major upward movement for ADA.

Featured image from Dall-E, chart from TradingView