Cardano Price Breaks Key Resistance, Potential Rally Expected

Based on chart indicators, the Cardano price has recently broken through a key resistance, indicating a potential uptrend. While the cryptocurrency is preparing for a possible bullish rally, an analyst has noted downside risks if Cardano fails to maintain crucial support levels.

Cardano Price Breaks Falling Wedge Resistance, Signals Uptrend

The Cardano price appears to be on a bullish trajectory, as analyst ‘MyCryptoParadise’ on TradingView shared an analysis of recent price movements. Cardano has broken through descending resistance in its Falling Wedge pattern.

This pattern is typically considered a bullish signal, associated with positive trend reversals. The Falling Wedge indicator features two descending trend lines representing highs and lows.

The analyst indicated that Cardano's price is nearing a "demand zone." A strong rebound from this point could initiate the anticipated upward trend. The demand zone at $0.0313 serves as a vital support level where buying interest is likely. A bounce from this level may enable Cardano to break out above the $0.417 resistance level, reinforcing the bullish scenario and suggesting higher resistance targets.

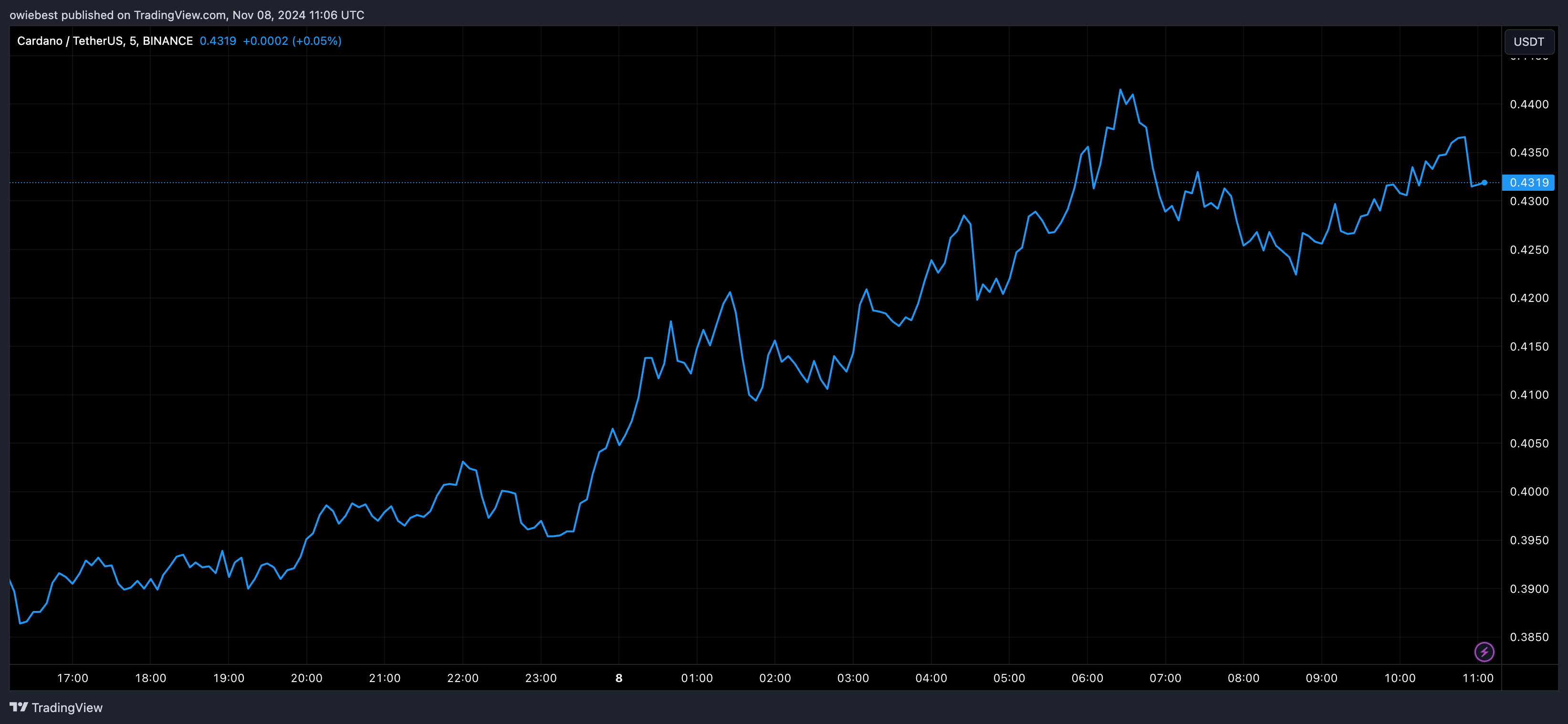

The market expert noted that breaking the $0.417 resistance could shift Cardano's current market structure. Recently, Cardano has experienced slow growth and muted performance, leading some investors to label it a "dead coin" or a "ghost chain." However, Cardano's price has seen significant gains in recent weeks.

As per CoinmarketCap data, the Cardano price is currently trading at $0.434, reflecting a 17.29% increase in the past 24 hours and a 27.84% rise over the past week. Additionally, daily trading volume has surged by more than 65%, indicating renewed investor interest in the altcoin.

Potential Risks If ADA Fails To Hold Key Support Levels

TheCryptoParadise outlined the risks if Cardano does not maintain critical support around $0.313. Failure to hold above this level might lead to a decline toward the support zone between $0.274 and $0.290.

This support zone is crucial as it may attract buyers to prevent further price drops. The analyst emphasized that ADA must reclaim the $0.313 support to sustain a bullish outlook. A daily close below $0.274 would likely invalidate this scenario, increasing the risk of further declines and potentially setting a new low.