Cardano Surges Past $1 Amid Strong Network Growth and Activity

Cardano (ADA) surpassed $1 over the weekend, reaching a multi-year high of $1.15 before experiencing a 17% correction as profit-taking occurred. Despite this pullback, the long-term outlook remains positive due to renewed market momentum over the past three weeks.

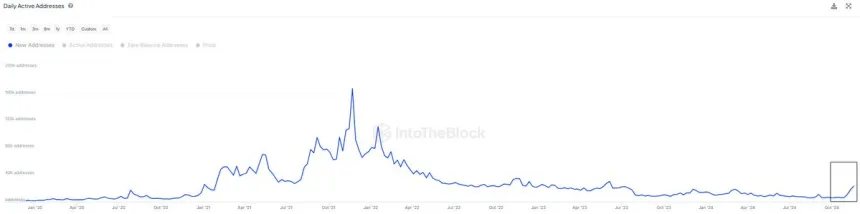

The price action indicates a maturing market, with ADA consolidating gains and preparing for its next move. On-chain data from IntoTheBlock shows increased network activity, reflecting growing interest and adoption, suggesting that the consolidation phase may be temporary as the broader market strengthens.

Maintaining key support levels during this correction is critical for Cardano's future direction. Analysts believe the network's fundamentals and favorable macro environment could drive ADA to new heights. Traders are closely monitoring the $1 support level, while evolving network metrics suggest a potential breakout may occur soon.

Cardano Daily Active Addresses Growing

Cardano's network activity is on the rise, with daily active addresses significantly increasing. According to IntoTheBlock, the number of new user addresses has reached its highest level since June 2023. This growth in network activity indicates rising adoption and interest in the Cardano ecosystem, vital for its long-term development.

Reclaiming the $1 level signifies an important psychological milestone, and despite current price consolidation, the surge in network growth suggests optimism about ADA’s future. IntoTheBlock’s analysis indicates Cardano might be preparing for a bullish breakout, potentially leading to new price levels as the consolidation stabilizes.

Even after pulling back from $1.15, Cardano remains over 230% away from its all-time high of around $3.1, indicating substantial upside potential as the network matures and attracts more users.

Should the price maintain support above $1 and continue upward network growth, Cardano could be set for its next bullish move. The increase in daily active addresses and significant distance to its ATH supports the potential for a strong rally, with investors watching to see if Cardano can sustain momentum and leverage surging network activity in the coming months.

ADA Demand Remains Strong

Currently trading at $0.93, Cardano experienced a 250% increase from November 5 to its yearly high of $1.15, followed by a 17% retracement as it seeks strong demand above the $0.90 level. This retracement fits within the normal consolidation process following a sharp rally, with ADA needing to hold above $0.90 to preserve bullish momentum.

If ADA maintains this level, it could lead to a potential breakout, targeting supply levels above $1.25. This would suggest the current pullback is a healthy correction before another upward movement.

Conversely, should ADA fall below $0.90 without reclaiming support, a deeper correction may ensue, potentially testing lower levels near $0.80, where further demand might emerge.

In summary, ADA's longer-term price action appears bullish, but maintaining support above $0.90 is essential for continuing its upward trajectory and reaching new supply levels above $1.25.

Featured image from Dall-E, chart from TradingView