7 0

Chainlink Faces Pressure as $50M Withdrawn from Binance in a Week

Chainlink (LINK) Market Overview

- Chainlink is facing pressure, trading below $13 and failing to regain previous bullish momentum.

- Analysts caution potential further downside before recovery, given the fragile market sentiment.

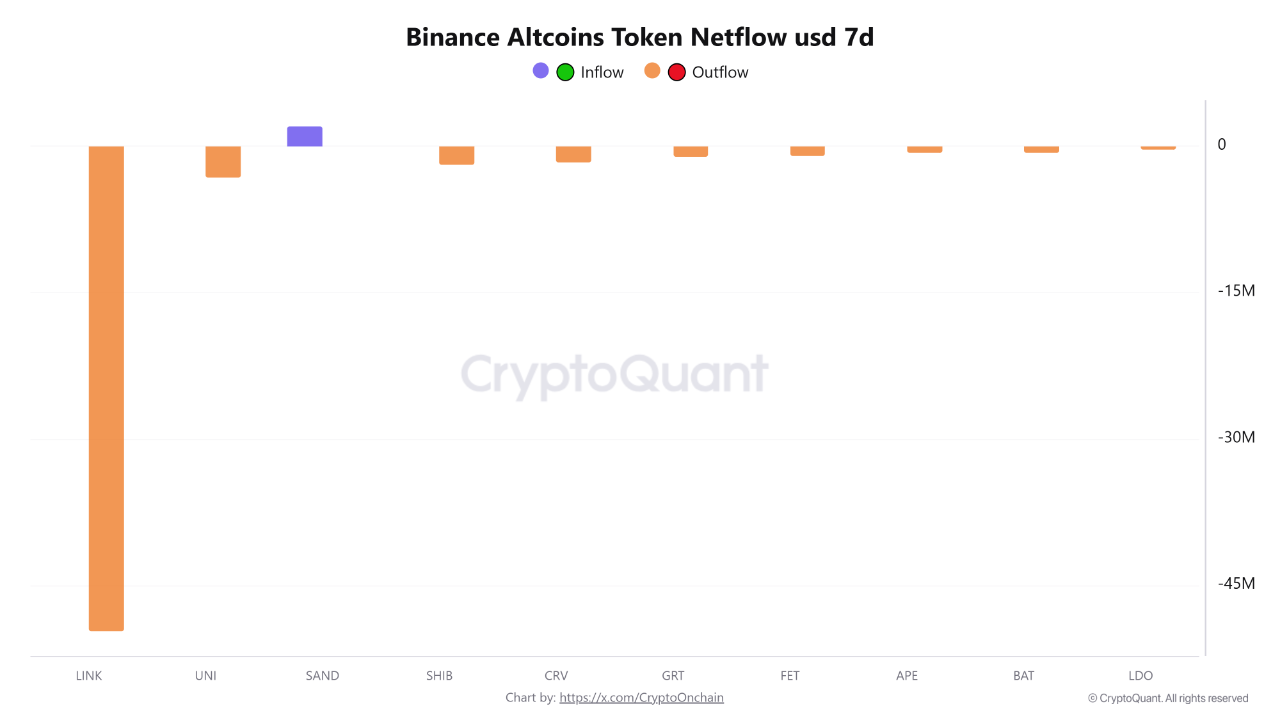

On-Chain Data Insights

- Despite weak price action, on-chain data indicates increased accumulation activity.

- Exchange outflows total approximately $50 million, signaling reduced selling pressure as holders move LINK to self-custody or long-term storage.

- This behavior suggests an accumulation phase amid weak prices.

Technical Analysis

- LINK's price rests on a long-term bullish trendline, acting as dynamic support since 2020.

- The convergence of heavy exchange outflows and retesting major historical support signals smart money accumulation.

- A successful defense of this support level could preserve Chainlink’s long-term bullish structure.

Structural Demand Testing

- LINK trades around $12.50, with a medium-term downtrend confirmed by lower highs.

- Price is below short- and medium-term moving averages, indicating corrective rebounds rather than impulsive ones.

- The $12–$13 range is a critical support area that has historically attracted demand during market weaknesses.

- Reduced volume in recent price action suggests stabilization over distribution.

- Bulls need to reclaim the $15–$16 zone for a meaningful trend reversal.