Chainlink Flips Key Resistance Level Into Support Amid Market Revival

The crypto market exhibited signs of revival, with several assets showing significant price increases. Chainlink (LINK) gained over 15% in 24 hours, emerging as a strong altcoin amid shifting market sentiment.

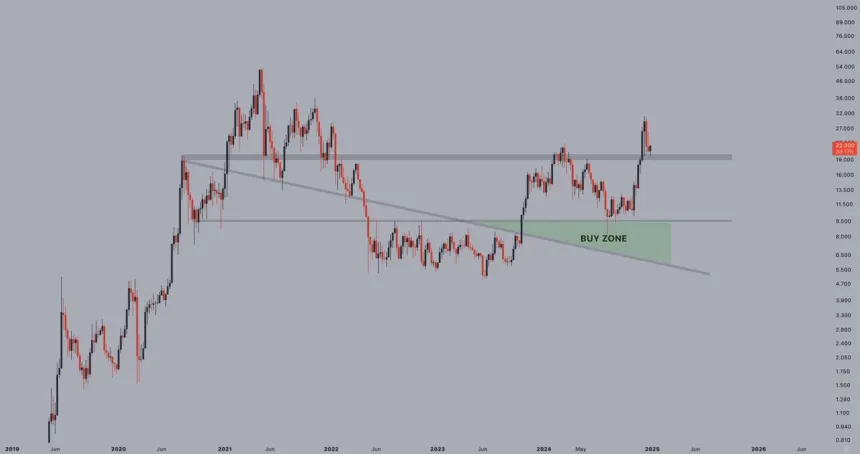

Analyst Jelle provided a technical analysis indicating that LINK has flipped a key resistance level into support, signaling potential upward momentum. This structural change may enable Chainlink to target higher price levels while testing crucial supply zones.

Chainlink Investors Waking Up

Chainlink faced selling pressure since reaching $30 on December 13 but recent price movements indicate a shift as bullish activity resurfaces. Analysts suggest this could initiate a substantial rally. Jelle noted that LINK's conversion of resistance into support indicates optimism among investors and suggests possible all-time highs if current trends continue.

LINK's ability to breach critical supply zones will be vital for an aggressive rally as buyers seek opportunities in the recovering market, positioning Chainlink as a leader in the altcoin sector.

Testing Crucial Liquidity

Currently trading at $22.55, Chainlink reflects a bounce from local demand levels and is testing a key supply zone that could dictate its next movement. LINK is above the 4-hour 200 EMA at $22.27, a bullish indicator when maintained as support.

Bulls must hold above this level to confirm LINK’s short-term uptrend. If support is sustained, the next significant hurdle is $24. Reclaiming this level could lead to a breakout toward higher resistance zones and potential all-time highs.

Failure to maintain the 200 EMA as support could result in renewed selling pressure, pushing prices back toward local demand. Traders are monitoring these technical indicators closely as the broader market recovery creates favorable conditions for altcoins.

Featured image from Dall-E, chart from TradingView