11 0

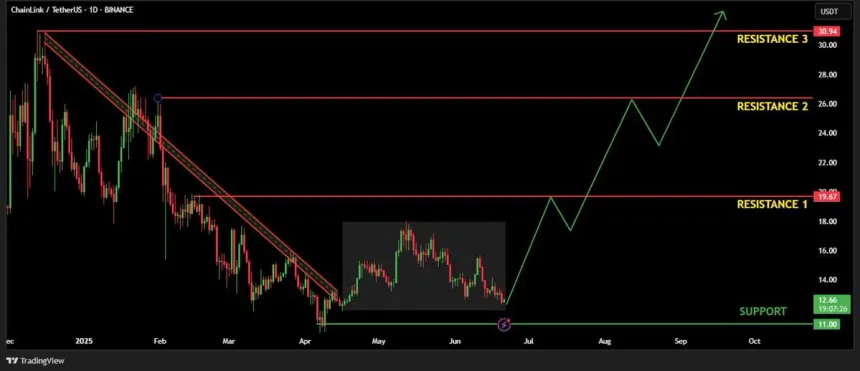

Chainlink Gains 21% Amid Market Uncertainty, Approaches Key Resistance Levels

Chainlink (LINK) has increased by 21% since its Sunday lows, demonstrating resilience amid a volatile macro and geopolitical environment. Key points include:

- Strong partnerships and on-chain fundamentals support LINK's price movement.

- Analyst Henry Lord notes rising volume and volatility, indicating a potential end to the accumulation phase.

- LINK remains in a consolidation range, with a breakout above key resistance necessary for upward momentum.

- Currently trading over 25% below its May high due to broader market uncertainties.

- A breakdown below current levels could lead to deeper corrections.

- Link’s recent rebound from $11.50 to above $13.20 shows early signs of a trend reversal.

- The price is testing the 100-day simple moving average at around $14.65; a break above this level could target $17–$18.

Overall, while Chainlink shows signs of recovery, traders remain cautious as confirmation of a breakout is still required.