Updated 28 December

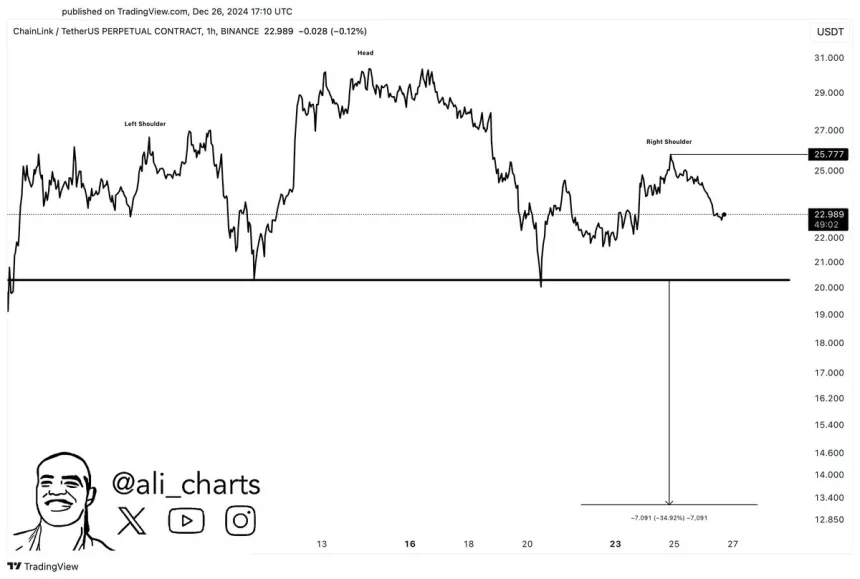

Chainlink Forms Head-and-Shoulders Pattern, Potential Drop to $14

Chainlink (LINK) has recovered over 30% after a 35% drop from yearly highs, currently testing liquidity around $23. Despite this rebound, bearish sentiment persists among altcoins, including Chainlink, which struggles to regain local highs and raises questions about the sustainability of its recent rally.

Analyst Ali Martinez highlighted a potential head-and-shoulders pattern, typically indicating bearish reversals. Confirmation of this pattern could lead LINK to decline to approximately $14 in the upcoming weeks. Maintaining current levels is crucial to avoid deeper corrections, with $23 identified as key resistance. The outcome will depend on broader market conditions and Chainlink's ability to counteract the bearish trend, leaving its outlook uncertain.

Chainlink Price Action Showing Weakness

LINK has encountered challenges since its peak, reflecting overall bearish trends in the altcoin market. While there has been some recovery, significant resistance exists around $26. Reclaiming this level is vital for reversing bearish sentiments and fostering bullish momentum.

Ali Martinez remarked on the possible formation of a head-and-shoulders pattern, which could result in a drop to $14 if confirmed. This scenario underscores the difficulties LINK faces in regaining its previous highs.

Nonetheless, holding above $22 may provide Chainlink with a foundation to stabilize and potentially reverse the bearish trend. A decisive move above $27 would further bolster bullish momentum, signaling a shift towards a more positive outlook.

The market remains uncertain, influenced by broader conditions, particularly Bitcoin’s performance. If LINK can navigate these key levels effectively, it may dispel the bearish narrative and set the stage for a sustained rally. Until then, caution is advisable for traders and investors.

LINK Testing Liquidity

Currently trading at $23, Chainlink has tested demand at the $22 level. Although this support level holds, price action lacks clear direction, creating uncertainty among traders. Bears maintain control, and the retrace from yearly highs continues to impact sentiment. However, the resilience of the $22 mark suggests potential surges in demand that could restore an uptrend.

For LINK to escape this indecisive state, it must surpass critical resistance at $26. Achieving this would invalidate the current bearish outlook and could ignite a significant rally, restoring trader confidence and attracting new buyers.

If LINK fails to maintain above $22, it may face increased selling pressure, risking lower support levels and prolonging the bearish trend. The coming days are pivotal for LINK as it seeks direction amid market uncertainty.

Featured image from Dall-E, chart from TradingView