Chainlink Could Reach New All-Time High If Resistance Is Broken

An analyst has detailed how Chainlink (LINK) could reach a new all-time high if it surpasses current resistance levels.

Resistance at the $20 Level

Analyst Ali Martinez discussed LINK's resistance barriers in a recent post. The analysis utilizes on-chain cost basis distribution to assess price levels.

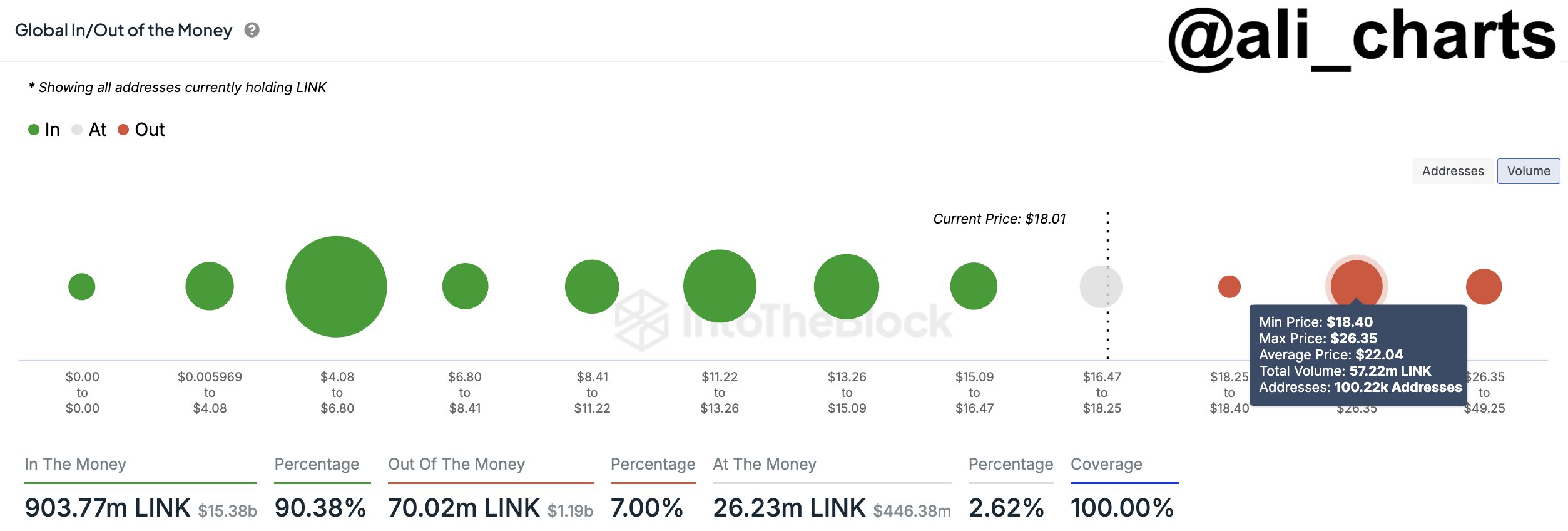

The following chart from IntoTheBlock illustrates the acquisition prices of LINK tokens throughout its history:

The graph indicates that many investors bought LINK between $18.4 and $26.3, with approximately 100,220 addresses acquiring 57.2 million LINK in this range.

On-chain analysis measures the potential for price ranges to act as support or resistance based on the volume of coins purchased within those ranges, reflecting investor psychology. Investors view their cost basis as significant; a retest can influence their profit-loss status. This leads to potential panic selling among those facing losses or increased buying from those hoping for profitability.

If numerous investors have similar cost bases, a retest can result in significant price fluctuations.

The average value around $22 represents a critical cost basis for many investors, suggesting LINK may struggle to break through this level. However, if it does, there could be minimal resistance until a new ATH, as fewer investors hold positions above this threshold.

Nearby support levels include $13 to $15 and $11 to $13, which could help mitigate declines during corrections.

Current LINK Price

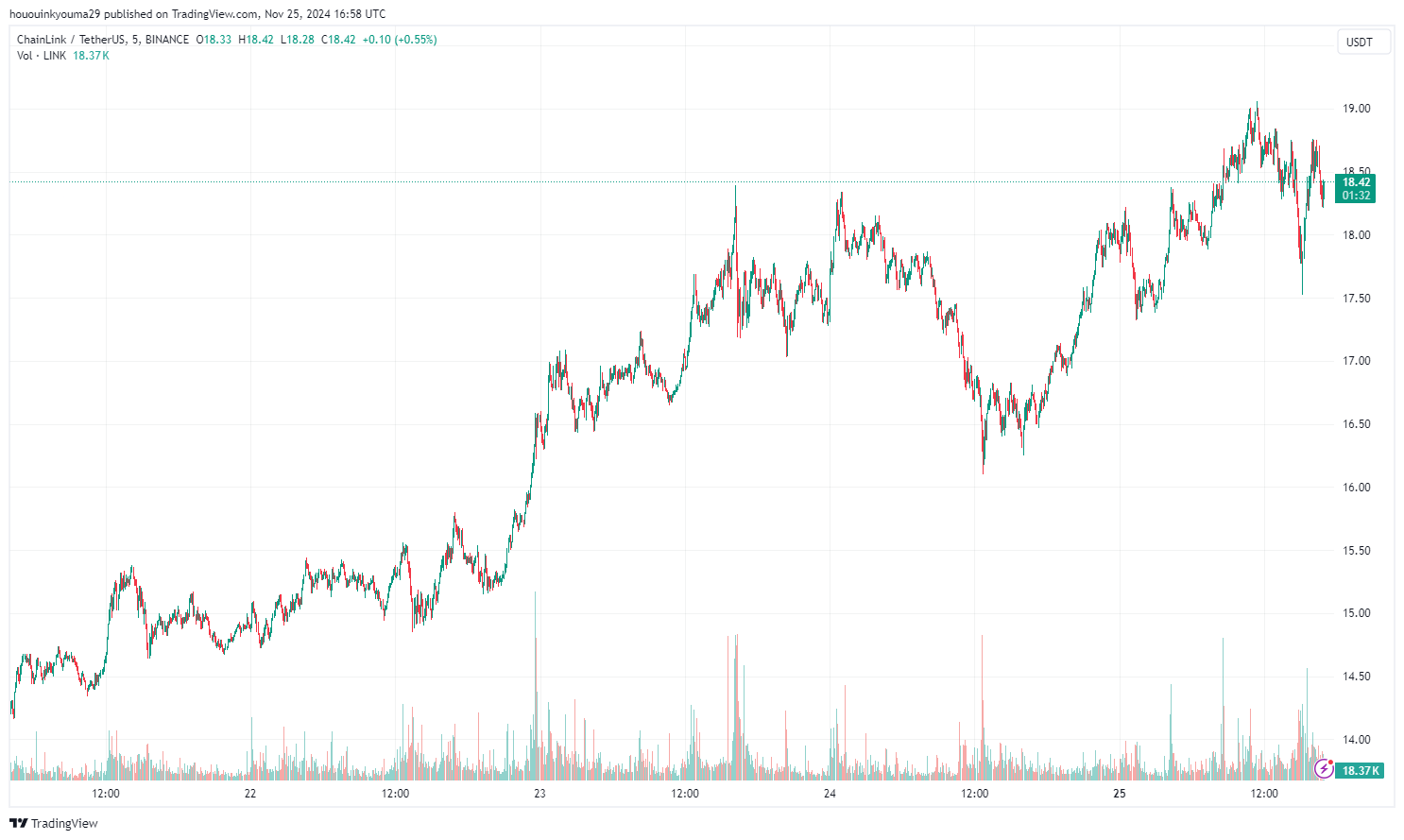

Chainlink has experienced nearly a 10% rally in the last 24 hours, raising its price to approximately $18.4.