Chainlink (LINK) Price Rises 10.5% After Reaching $93 Billion TVS

Chainlink (LINK) price increased by 10.5% on August 12, reaching $24.2, the highest since February. Key drivers of this rise include:

- A partnership with Intercontinental Exchange (ICE) to integrate FX and precious metals rates into Chainlink data streams.

- A new all-time high in Total Value Secured (TVS), now at $93 billion across various DeFi protocols.

ICE's integration provides over 2,000 applications, banks, and asset managers with access to secure institutional-grade data, facilitating the development of tokenized assets and automated settlement systems.

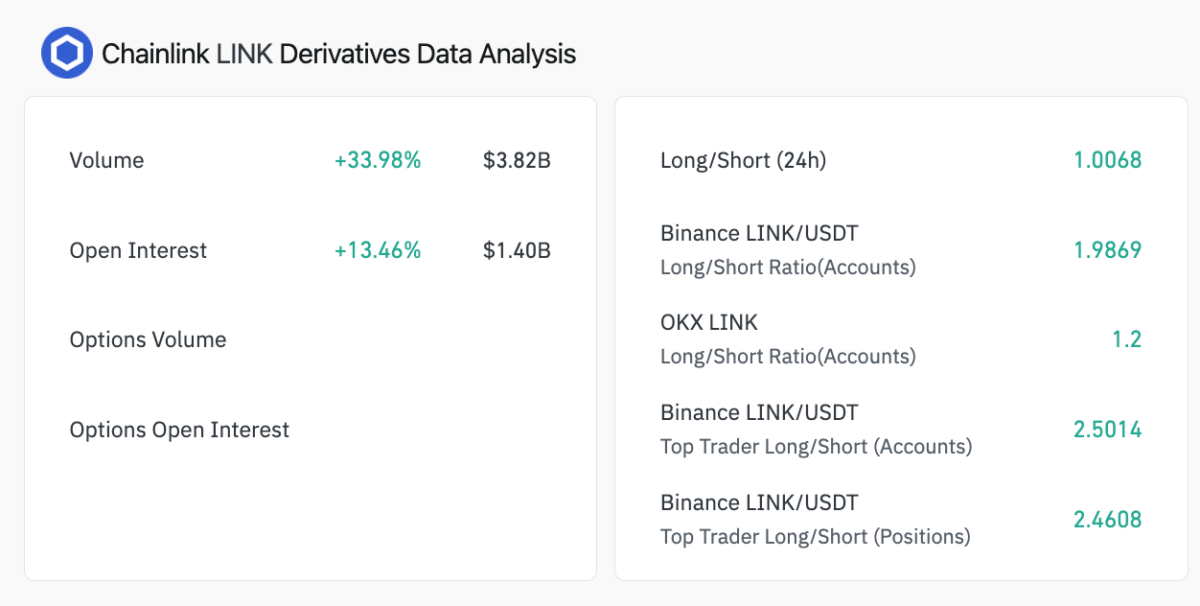

Derivatives volumes rose by 33% to $3.8 billion, with Open Interest hitting a record $1.4 billion. The potential for profit-taking exists around the $22 mark, while bulls may target $25 as a long-term goal.

Technical indicators suggest LINK is in a bullish trend. The Relative Strength Index (RSI) stands at 72.42, indicating overbought conditions without extreme reversal signals. Current support levels are at $21.70 and $20.01.

The next resistance level is at $25.19, last reached in March. A breakout above this could lead to a rally towards $27, depending on trading volume and market sentiment.

As Chainlink’s adoption grows, interest in Solana-based projects like Snorter is increasing due to their low fees and fast execution speeds.