Chainlink Price Surges 40% Amid Increased Whale Activity and Investor Interest

Chainlink (LINK) has recently gained attention in the cryptocurrency community, experiencing a 40% increase in one week. The price rose from $16.54 on November 26 to $25.73 by December 3, marking the largest increase since January 2022 and reflecting renewed investor enthusiasm.

Surge Fueled By Whale Activity

Whale activity significantly contributed to this rally. On December 3, LookonChain reported that a whale purchased 269,861 LINK tokens for $6.68 million, including 107,838 tokens on a decentralized exchange for $2.6 million. Additionally, 162,024 LINK tokens valued at $4.08 million were withdrawn from Binance, indicating heightened institutional interest.

The price of $LINK has surged 36% today!

A whale bought 269,861 $LINK($6.68M) in the past 12 hours.

The whale spent $2.6M to buy 107,838 $LINK at $24.1 on DEX and withdrew 162,024 $LINK($4.08M) from #Binance.https://t.co/Zuxgpk23Sm pic.twitter.com/hNQ65oZkfi

— Lookonchain (@lookonchain) December 3, 2024

This trend is not limited to whales. Small and medium-sized investors are also increasing their holdings. Data from IntoTheBlock indicates a 35% rise in LINK tokens owned by small buyers (1,000 to 10,000) over the last 30 days, while mid-tier investors (holding 10,000 to 100,000 LINK) saw an 86.79% increase in accumulation.

Bullish Forecasts & Strong Market Performance

Chainlink's market capitalization has surpassed $15 billion, following a 25% increase within 24 hours. This performance contributes to optimism in the DeFi sector, approaching a $150 billion market capitalization.

$LINK/usdt DAILY

It’s $LINK SEASON, now we do $22 –> $52

https://t.co/kJOaCpeyML pic.twitter.com/dg3H5au2fU

— Satoshi Flipper (@SatoshiFlipper) December 3, 2024

Analysts, including well-known figures like Satoshi Flipper, have predicted a target price of $52 for LINK. A breakout rally mimics the 2022-2023 trendline breakout, suggesting potential for significant market rebounds.

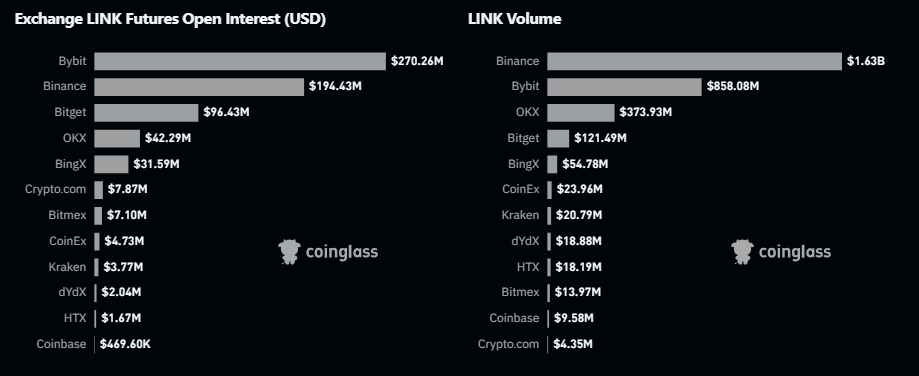

Coinglass indicators show a 57% growth in futures open interest to $708 million, with trading volume in derivatives rising 450% to $5 billion, indicating increased speculative activity favorable for LINK’s growth.

Chainlink: The Road Ahead

The current price surge suggests potential for continuation; however, its long-term success will hinge on sustaining momentum. Increased purchasing pressure and whale activity indicate persistent optimism. Investors should remain cautious due to market volatility. If LINK maintains its upward trajectory, new price milestones may be achieved in the coming weeks.

Featured image from IndiaMART, chart from TradingView