Chainlink Price Target of $30 Predicted Amid Whale Accumulation

Chainlink (LINK) is experiencing notable momentum in the cryptocurrency market, with speculation that its value could rise to $30. Currently trading at approximately $13.45, LINK has shown significant price momentum due to various factors indicating potential upside.

Market Factors Influencing Price

Key factors affecting LINK include whale activity, technical indicators, and overall market trends. Increased whale accumulation, lower exchange supply, and heightened on-chain activity support a bullish outlook. If the bullish flag pattern succeeds, predictions suggest LINK may challenge $30, representing a 125% increase from its current price.

Whale Accumulation

Whale activity has significantly contributed to LINK's recent price movements. In the past seven weeks, major holders have accumulated $370 million in LINK, marking an 8.2% increase in holdings. This accumulation often indicates optimism about the token's future, as these investors typically maintain their positions long-term. The recent break above $13.30 has sparked additional buying interest, suggesting potential for further price increases if LINK remains above this level.

Reduced Selling Pressure

Decreased selling pressure on exchanges supports LINK's price potential. CryptoQuant data shows a significant rise in withdrawals, reaching a 30-day high on November 8. Reduced tokens on exchanges typically indicate that holders are not looking for quick trades, leading to market tightness. As demand rises amid limited supply, LINK's price may increase further.

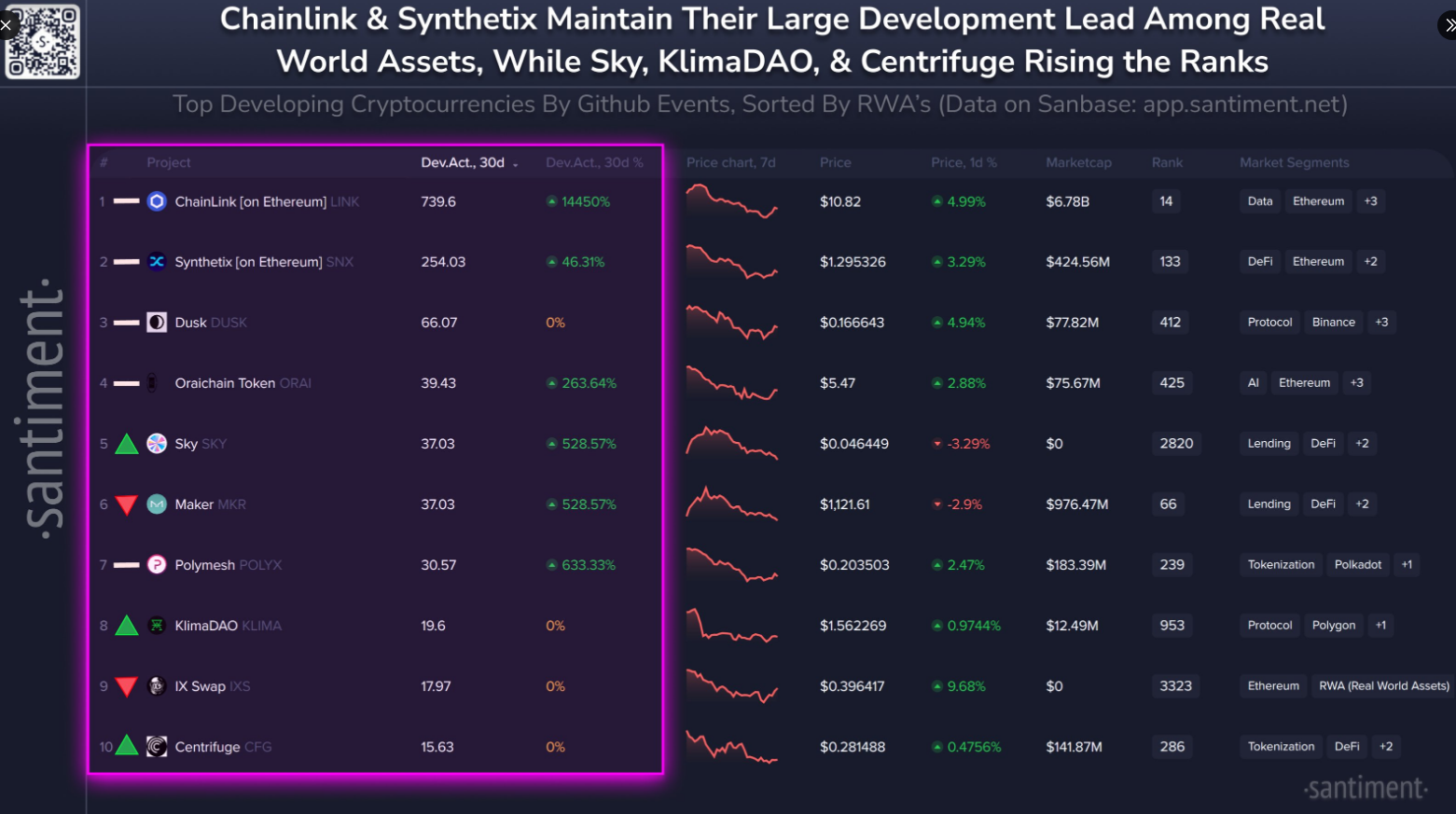

Here are crypto’s top Real World Assets (RWA’s) by development...

1) @chainlink $LINK

— Santiment (@santimentfeed) November 5, 2024

Development Activity and Partnerships

Chainlink's development activity has surged by 4,000% over the past month, contributing to its potential for long-term growth. Partnerships with financial institutions such as Swift and UBS position Chainlink favorably in addressing data fragmentation in the financial sector. The network's oracles facilitate real-time data validation, enhancing its relevance in decentralized finance applications. Increased institutional adoption can further bolster Chainlink's utility and value, supporting sustained price levels.

Overall, Chainlink appears well-positioned for a potential rally, driven by ongoing development, whale accumulation, and favorable technical indicators.

Featured image from Pexels, chart from TradingView